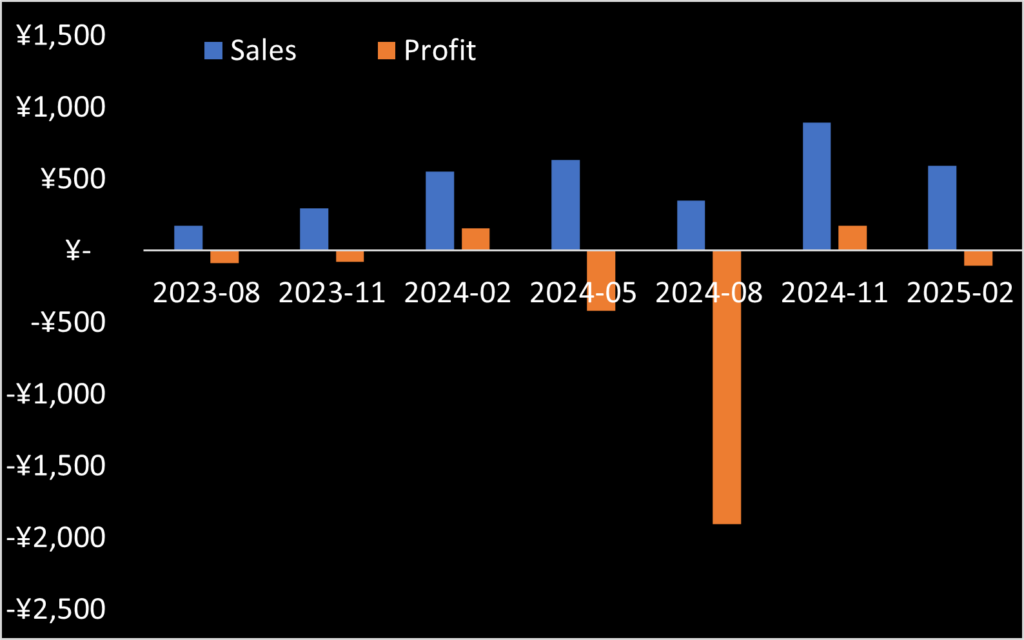

iQPS (TYO: 5595) reported its latest quarterly financials for the quarter ending February 2025. Revenue was down, presumably due to the in-orbit issues experienced by satellites QPS-5 and QPS-6, as previously reported. Despite a design life of five years, QPS-5 lasted eight months before its telemetry system failed in August 2024. QPS-6 operated for a slightly longer 16 months before succumbing to faulty thrusters. Consequently, iQPS planned a constellation of four commercial satellites deployed as of last quarter, but instead only had two.

Accompanying iQPS’s quarterly financial report was a new set of slides that revealed an upward revision in projected satellite costs. iQPS previously in April 2024 projected ¥1 billion to build and launch each satellite (~$6.9m). Just one year later, this figure ballooned to ¥1.5 billion. iQPS now attributes approximately ¥1 billion for launch costs and ¥0.5 billion (~$3.5m) for satellite manufacturing.

This overall cost increase appears due to iQPS switching launch providers from Falcon-9 to Rocket Lab’s Electron. Satellites QPS-2, QPS-6, QPS-7, and QPS-8 utilized SpaceX’s Falcon-9 rideshare program, which launches groups of satellites into Sun-synchronous orbit (SSO). SSO orbits traverse both polar regions, offering world wide coverage but at the expense of satellites traversing over areas with minimal commercial interest for SAR imagery for extended periods. iQPS launched satellites QPS-5 and QPS-9 into mid-inclination orbits using Rocket Lab’s Electron rocket. Such inclined orbits avoid the poles and spend more time over areas of commercial interest. iQPS has seven more launches reserved on Electron. (However, SpaceX now offers Falcon-9 rideshare (Bandwagon) launches to mid-inclination orbits, a capability iQPS has already utilized. It is not clear why iQPS picked Electron over presumably lower cost Bandwagon launches.)

iQPS noted that satellites in inclined orbits average generating 19.5 image sets per day over areas of potential customer interest. SSO orbiting satellites average 16.8 image sets per day, less due to orbiting over the poles. Paying 50% more to deploy satellites with only 16% increase in potential sales does not seem like a sound business decision.

However, the entirety of iQPS’s revenue comes from Japanese government sales. With this fact, the paying more to launch satellites into custom inclined orbits maximizing satellite time over Japan becomes clearer. A significant portion of the potential 19.5 and 16.8 image sets per day are in regions where iQPS seemingly has no customer demand. iQPS’s use of Rocket Lab to launch to a 42-degree inclination orbit, which passes directly over northern Japan, suggests that the 50% cost increase for launching on the Electron likely provides greater than 50% increase in satellite coverage over Japan, justifying the higher expense.

Blacksky comparison

iQPS revenue for the quarter ending February was ¥593 million (~$4.1m). Optical imagery provider Blacksky just posted $29.5m revenue for its quarter ending in March. iQPS has 1/7th Blacksky’s revenue but trades with a substantially higher market cap: $480m versus Blacksky’s $365m.

Regardless, iQPS needs to expand sales beyond Japan.