Blacksky (NYSE: BKSY) reported first-quarter 2025 results last week, highlighting a 22% year-over-year quarterly revenue increase, backlog growth, and high-quality imagery from new Gen-3 satellites. However, examination of Blacksky’s 10-Q filing reveals that U.S. government quarterly revenue fell to a three-year low. Potentially related, Imagery and Analytical Services revenue per satellite abruptly declined after seven quarters of near-continuous growth. Blacksky’s quarter was buoyed by $9.7 million in revenue from a new “Engineering and Integration” customer, designated as Customer B. We identify this as India. Following the report, Blacksky stock surged 25%.

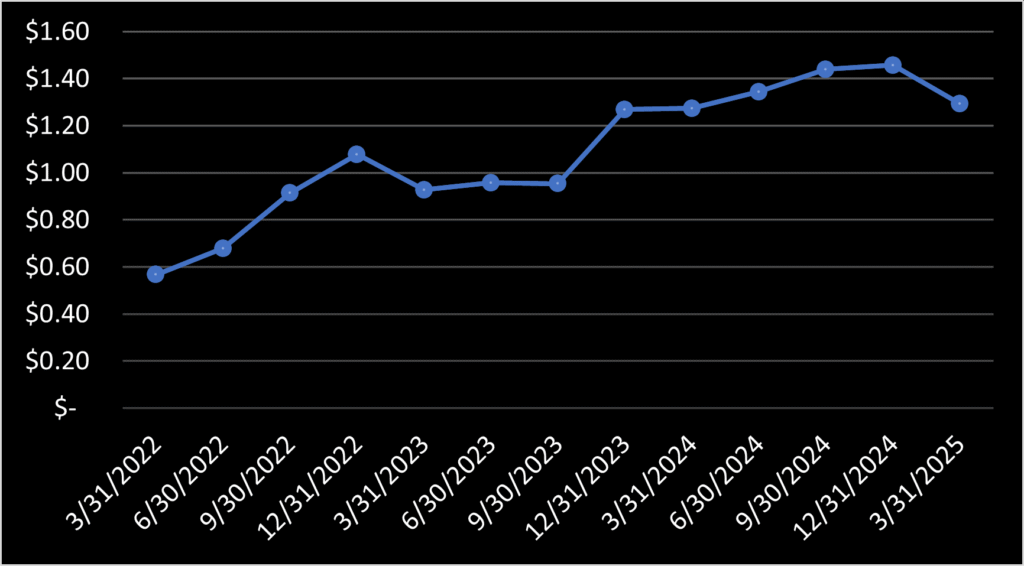

Blacksky describes Imagery and Analytical Services segment revenue as “high margin.” Such revenue in 2025 1Q totaled $16.8 million. It has been on a slow decline from a peak of $19.0 million in fourth quarter 2023. As of March 31, 2025, Blacksky had 13 satellites in orbit. The Imagery and Analytical Services revenue per satellite, had steadily increased over the past two years to $1.46 million reach 4Q 2024. This suddenly dropped to $1.29 million in Q1 2025. Even if one discounts Blacksky’s newly launched Gen-3 satellite because it is not yet generating revenue, the ratio still falls to $1.40 million per satellite. This decline may signal decreased demand and warrants future monitoring.

Potentially related, Blacksky’s U.S. government revenue fell to $11.7 million, the lowest since Q1 2022 ($11.1 million). This is significantly down from a high of $19.7 million reach last year. U.S. government revenue now constitutes 40% of Blacksky’s total revenue, also an all-time low. One wonders whether the build-out of U.S. National Reconnaissance Office’s proliferated architecture constellation is reducing U.S. government demand for commercial satellite imagery. This also requires continued observation.

Blacksky’s quarter was apparently saved by $9.7 million in revenue from “Customer B,” comprising 33% of total quarterly revenue. (Note: Not to be confused with the prior Customer B. Blacksky apparently re-ordered and re-anonymized its customers in this quarter’s filing.) Judging by the similar amount of “Engineering and Integration” revenue ($9.84 million), Customer B’s revenue likely stemmed entirely from engineering work. CFO Henry Dubois indicated on the investor call this revenue was from India, making Customer B all but certainly India. Blacksky announced its contract with India in February.

Customer D (believed to be prior Customer C, likely Israel) contributed less than 10% of Blacksky’s total revenue for the first time in six quarters. Revenue dropped significantly from a quarterly high of $4.24 million. Total revenue from this customer has fallen to below $2.51 million.

Cash reserves and Dubois’s forecast during earnings call

Perhaps most significantly, CFO Dubois stated Blacksky has the equivalent of $136 million in cash, asserting, “Given this liquidity profile and our expected performance, we believe we are fully funded to deploy our baseline constellation of 12 satellites and get to free cash flow positive.” If true, this would be a gift to investors. One can see why the stock rose 25% following this statement.

However, caution is warranted. This is not the first time Blacksky management assured investors about being fully capitalized. During a May 2024 conference call, management claimed the company was “fully funded.” This statement proved untrue. Four months later Blacksky sold more stock to raise capital.