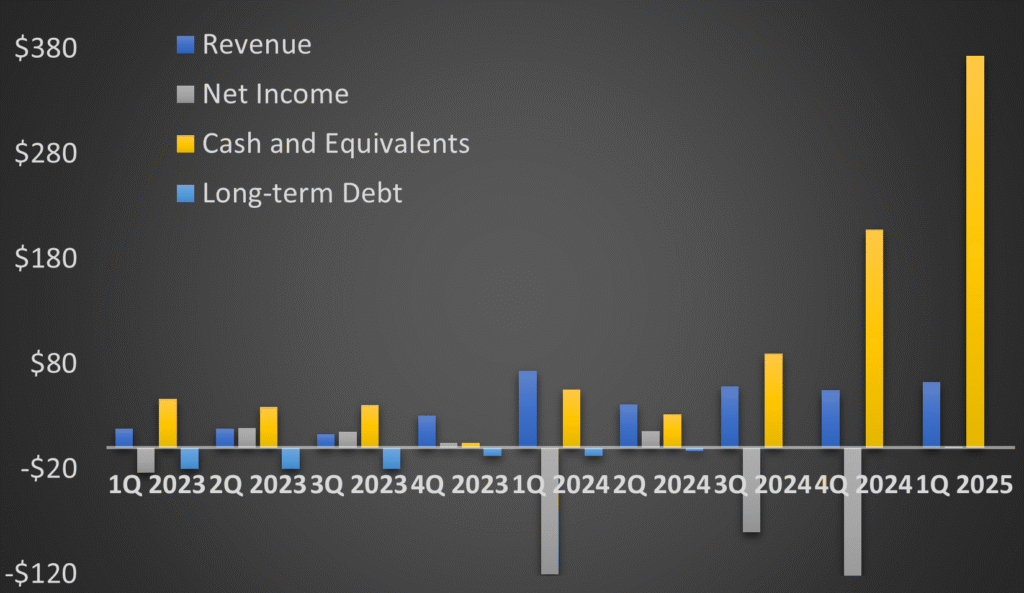

Intuitive Machines (NASDAQ: LUNR) posted first-quarter revenue results. The chart of LUNR’s revenue, operating income, cash, and debt might appear misleading; the growing metric is cash, not revenue. LUNR’s revenue has remained relatively flat over the past five quarters. Operating at a loss, LUNR has increased cash through warrant redemptions and selling new stock, resulting in impressive current cash level. Intuitive Machines stock rose 26% on the news.

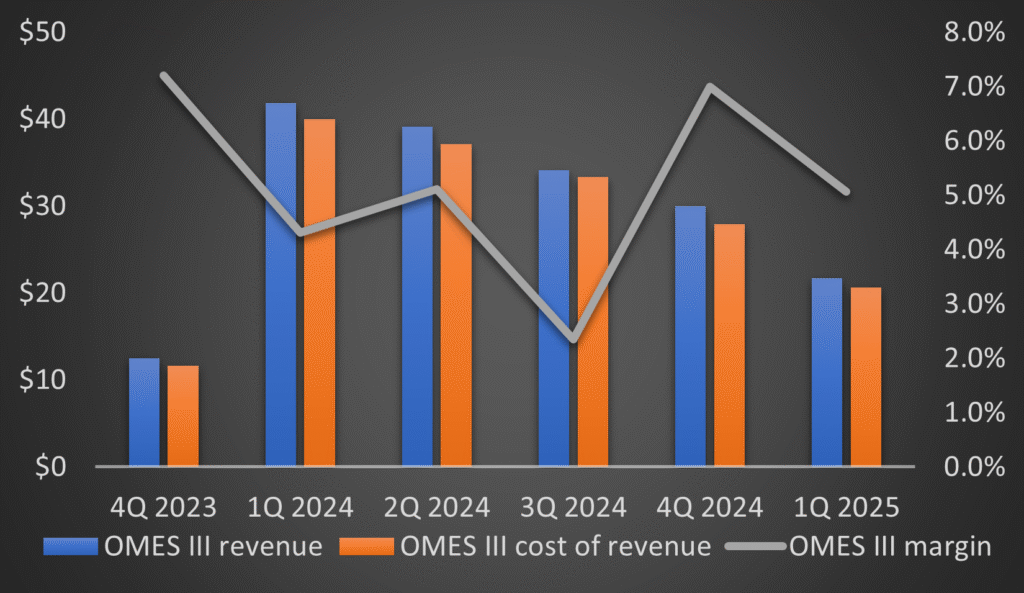

Notably absent from the quarterly investor presentation was any mention of OMES III, despite it contributing 35% of the quarter’s total revenue. OMES III is LUNR’s first large profitable contract, but it is apparently shrinking. Quarterly revenue from OMES III has declined from $41.8 million in Q1 2024 to $21.7 million last quarter.

IM-2 failed landing and next lunar mission: IM-3

Additionally, Intuitive Machines disclosed three factors contributing to the IM-2 landing sideways, details already reported by SpaceNews. Hopefully, addressing these issues will enable them to complete the IM-3 mission landing upright, maximizing IM-3’s associated final milestone payment.

However, customer interest in placing payload on IM-3 appears stagnant. Total customer contracted revenue on IM-3 has remained at $93 million since September 2024 (technically, it grew from $93.0 million to $93.1 million). This lack of demand is unsurprising after two failed landings. Especially after Firefly landing upright, it should be no surprise if customers perform to fly with Firefly over over paying to ride on IM-3. LUNR also recorded $200k in additional loss charges on IM-3 last quarter, bringing total losses recorded to date to $24.5 million.

Potential future profitable contracts

Nevertheless, LUNR disclosed in their 10-Q filing that new revenue streams materially contributed to quarterly revenue. Specifically, the NSN contract for lunar data relay services provided $3 million, and the Lunar Terrain Vehicle (LTV) contract contributed another $6.9 million. LUNR disclosed neither as loss contracts, so both are presumed to be profitable.

The investor slides also highlighted three new business endeavors:

- Orbital Transfer for a U.S. government customer, first mentioned with announcement of LUNR’s 2024 annual financial results.

- Development of an earth entry vehicle, potentially for lunar/Mars sample return or for returning biomedical experiments performed in space.

- Development of a nuclear-powered “stealth-like” satellite for the U.S. Air Force, apparently with applications for space situation awareness.