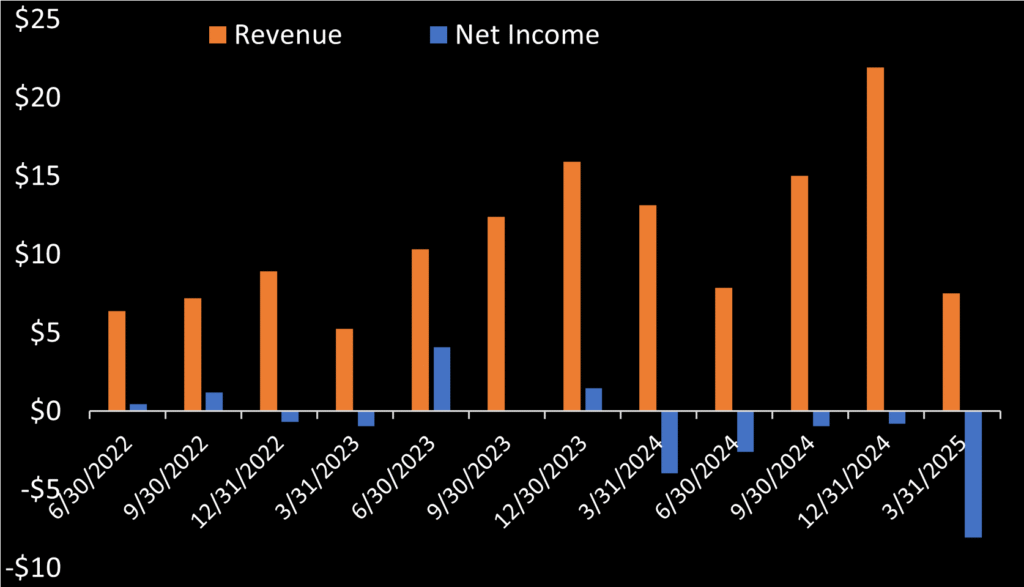

ImageSat International (TLV: ISI) had a tough 2025 first quarter, posting its largest net quarterly loss since going public three years ago. A quarter-on-quarter drop in revenue from $21.9 million to $7.5 million fueled ISI’s loss of $8.1 million. In 2021 and 2022, ISI posted net profit in seven out of eight quarters. ISI now finds itself in a five-quarter streak of recurring losses. An English-version investor slide deck suggests revenue was delayed to later quarters in 2025. ISI reduced its accounts receivable balance by $6 million, helping ISI, in light of the large loss, post a positive $2 million in operating cash flow.

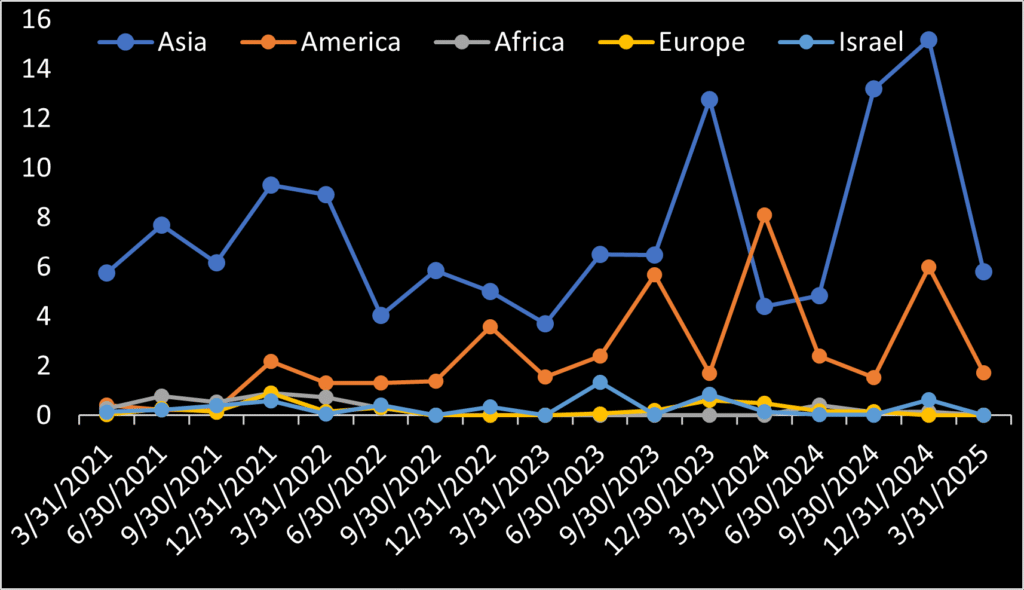

In the first quarter, ISI only recognized revenue from two of its five regions: Americas and Asia. American sourced revenue is almost certainly due to the ISI’s well known Chile contract.

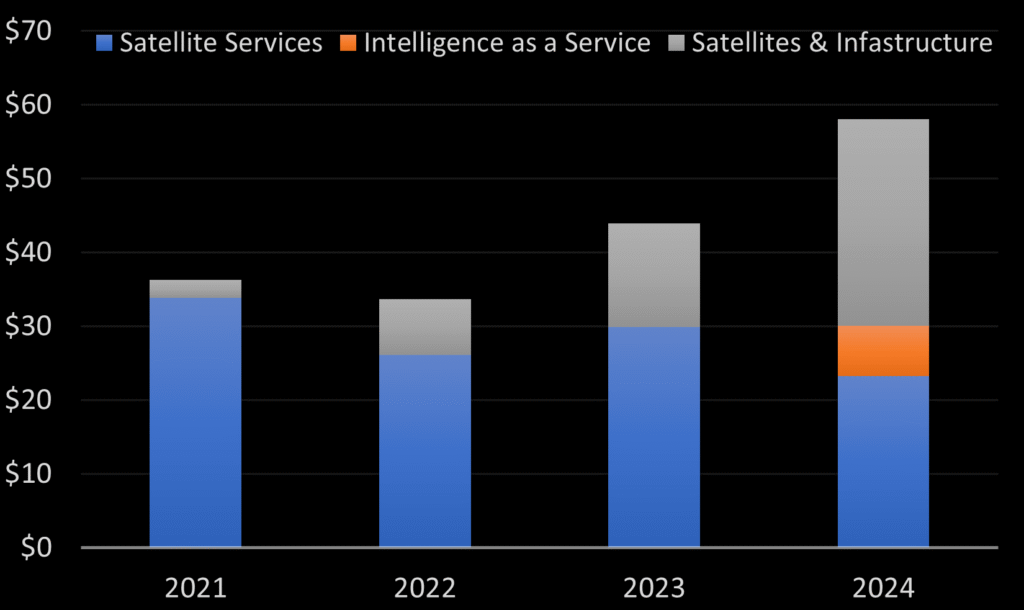

ISI now reports segmented revenue. They also re-reported historical revenue back to 2021 categorized by these segments. The “Satellite Services” segment is ISI’s long-standing imagery sales segment. Such sales have declined from $33.8 million to $23.3 million from 2021 to 2024. This suggests either worldwide demand for raw satellite imagery is decreasing, downward price pressure exists from over supply, or other satellite imagery providers are outcompeting ISI for this business. ISI’s “Satellites & Infrastructure” segment expanded over the same period. This segment covers ISI selling satellites and related ground stations and data centers. This rise is certainly due to Chile purchasing satellites and ground systems enabling autonomous control of its satellite imaging capabilities. Finally, ISI’s new “Data as a Service” segment encompasses data analytics services. Such segmented revenue first appears in 2024.

Perhaps most interestingly, ISI references the Quilty Space Research Earth Observation Quarterly Financial Review, April 2025, on page 15 of its investor deck. Chris Quilty is well-regarded on this site, known for asking insightful questions during BlackSky’s quarterly earnings call Q&As. Apparently, Quilty opines that the market for optical satellite imagery is saturated. Optical imagery satellite providers are thus shifting to provide hardware to governments, enabling autonomous satellite control and operation. This trend has been observed and covered on this here with contracts announced for BlackSky-India, BlackSky-Indonesia, and to some additional extent, GOMspace-Indonesia.