| Market Cap: ₩150B TTM revenue: ₩11.1B YOY return: -39.57% |

CEO: Myung-yong Nam Cumulative pay: ₩250k (est) Shareholder value created: -₩63.8B |

Forecast effort: D Forecast accuracy: F |

|

Lumir is a Korean satellite company focused on deploying a synthetic aperture radar (SAR) satellite constellation. Building upon the heritage from its first satellite launched in May 2023, Lumir has developed multiple satellite subsystems in-house. They specifically provide a SAR radar payload to the Korean government for its satellites. Lumir however went public in October 2024 based on a current-year business forecast that it ultimately missed by over ₩5 billion. This raised reasonable doubt over its 2025 and 2026 forecasts. Additionally, Lumir is heavily reliant on the Korean government for support, with 93% of space-related revenue sourced from the Korea Aerospace Research Institute in both 2023 and 2024. While South Korean space expenditures are growing, Lumir needs to quickly go to market and secure additional revenue if it is to achieve its planned six-fold revenue growth by 2026.

2 Minute Version

- Lumir is a Korean space company with a history of supplying satellite subsystems for Korean government satellites. They now aim to manufacture and provide their own satellites.

- They launched their first satellite, a 6U cubesat, as a demonstration project in May 2023.

- Lumir has developed various satellite subsystems in-house, including image data processing units, onboard computers, phased array antennas, and attitude control systems, in addition to SAR payloads.

- Lumir’s IPO failed meeting expectations. They initially aimed selling shares at ₩16,500-20,500 each. Due to investor skepticism, IPO shares sold for ₩12,000, resulting in 25-40% less cash raised than hoped.

- As a result of burning through cash post-IPO from posted losses, Lumir almost certainly lacks sufficient funds to finance operations, build its factory, and launch its SAR constellation, suggesting that more cash will need to be raised through debt or dilutive financing.

- The IPO proceeds were marketed for use in finishing the development of the SAR satellite platform and building a factory for manufacturing an 18-SAR satellite constellation.

- Approximately 30% of Lumir’s business is non-space related, as they manufacture actively regulated engine valves for marine use.

- Lumir’s business appears to be highly concentrated on two main customers: the Korean government’s KARI, which provided 93% of revenues in both 2023 and 2024, and HD Hyundai Heavy Industries, which purchased 100% of Lumir’s engine valves in 2023 (2024 data not available).

- Lumir’s pre-IPO business plan, as pitched to investors, seems extremely aggressive, as they already missed their 2024 revenue and income projections provided pre-IPO.

- Their forecast of ₩6.6 billion income on ₩41.7 billion revenue in 2025 specifically appears in doubt.

- Lumir’s stock price experienced significant losses following its IPO, falling by as much as 40%.

Lumir’s three business lines

Lumir’s space business relies almost entirely on South Korean government-funded contracts for revenue. They reporting three different revenue segments: satellite and satellite systems manufacturing, SAR imagery services, and marine product manufacturing.

Their satellite and satellite systems manufacturing arm focuses on selling satellite components and, presumably, full satellites. No customers are currently known to have ordered a complete satellite build. Lumir has notably developed multiple satellite subsystems in-house, including C-Band and X-band imaging radar (SAR/SR), image data processing units, onboard computers, attitude control, and a Ka-band phased array antenna. Their first satellite, Lumir-T1, a 6U cubesat, was launched in May 2023.

The second business line, SAR imagery services, involves Lumir launching its own satellites, collecting SAR imagery data, and then selling it to customers. They plan selling to the Korean government (presumably imagery taken over North Korea) and to a global customer base. IPO proceeds totaling ₩9.6 billion were designated for Lumir’s new four-story satellite R&D and manufacturing center, and ₩28.5 billion to build and launch LumirX. LumirX is a 150kg-class SAR satellite aiming for 0.3m resolution. The first satellite of a planed 18 satellite constellation is to launch in 2026. The estimated cost to finish development and build LumirX is ₩10.2 billion Won. For launch, Lumir budgets ₩8.6 billion Won ($6.3 million).

Finally, Lumir manufactures actively regulated engine valves used by the shipbuilding industry. HD Hyundai Heavy Industries, purchased 100% of Lumir’s valves in 2023.

Financial Disclosures

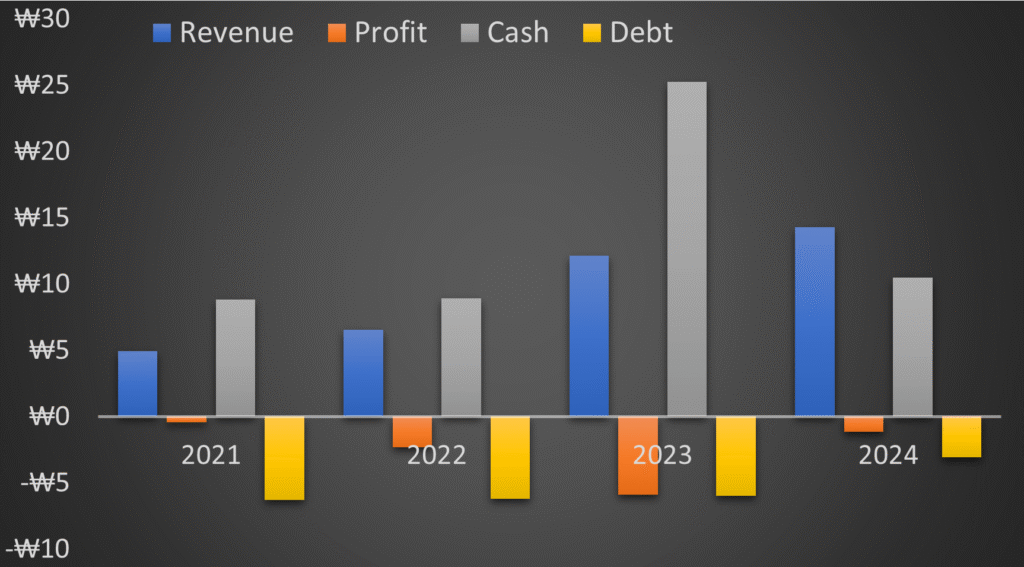

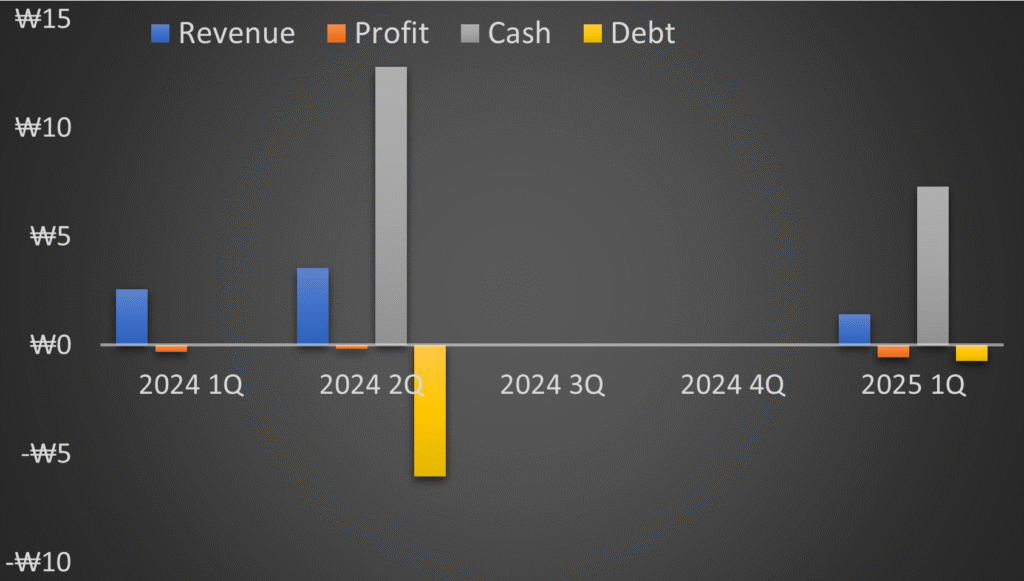

Lumir’s annual financials exhibit rising losses that appear to have peaked in 2023. In September 2024, Lumir forecasted ₩0.6 billion in net income for 2024. Instead, they lost ₩0.67 billion. However, the overall trend suggests that growing revenues at profitable margins could flip Lumir to profitability in 2025.

So far, the first quarter numbers for 2025 do not instill confidence that Lumir is on track. Quarterly revenue was just ₩1.4 billion, approximately 60% lower than the average quarterly revenue Lumir posted each quarter in 2024.

Lumir operates across three business segments: satellite and satellite systems, SAR imagery services, and marine products. Their satellite segment predominately stems from building and supplying satellite components. Lumir’s satellite services segment is to encompass data sold from their satellites (i.e., their future SAR constellation). So far this has been immaterial to date. Lumir’s maritime segment comprised approximately one-quarter of Lumir’s total sales in 2024. Lumir’s revenue growth appears evenly spread across both space and maritime.

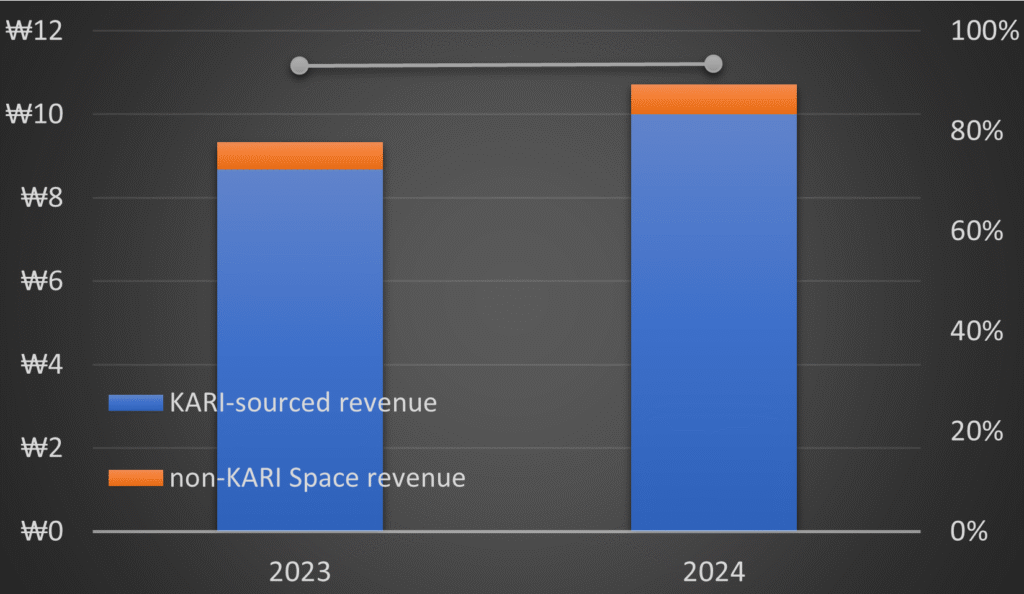

Lumir’s main challenge appears to be the lack of demand for its satellite products from commercial customers. Although they spent years developing satellite subsystems in-house, Lumir has not found significant demand for any of its products outside from the Korean government. In both 2023 and 2024, 93% of Lumir’s space-related revenue was from the Korea Aerospace Research Institute (KARI), a South Korean government agency. Lumir does not even appear to be actively marketing its satellite products; on the product section of its website, there is no button or option for contacting sales. And on the contact page, no option exists to contact sales (the first two options being for IR and public relations). This suggests Lumir may have created its website to drive investor interest in its stock more than driving customer interest in its satellite products.

On this point, Lumir’s maritime vessel part sales similarly appear heavily concentrated. In 2023, 100% of sales were to HD Hyundai Heavy Industries. Thus two customers, KARI and HD Hyundai Heavy Industries, account for 95% of Lumir’s entire business.

Lastly, backlog stood at ₩17.7 billion pre-IPO in June 2024. This has steadily declined to ₩12.0 billion as of the end of Q1 2025. Not an encouraging trend. Lumir forecasted ₩41.7 billion in revenue for 2025. It is difficult to see how they plan achieving this with a shrinking backlog three times less than the number they forecasted to achieve.

Management guidance scorecard

Lumir management, based on its track record established in connection with its IPO, has not build confidence with their guidance. Lumir failed to deliver on the 2024 revenue and income projections issued in September of that year. And it appears they will fail to meet its projections for 2025.

Lumir in 2025 apparently quit providing investors financial projections. They have however provided projections related to the launch of its LumirX satellite constellation

CEO compensation and performance

Nam Myeong-yong serves as CEO of Lumir. In Korea, individual CEO compensation must be disclosed in cases where it exceeds a threshold of ₩500 million (or ~$365k). Lumir noted in a recent quarterly report that “the company does not have any directors or auditors whose individual compensation exceeds ₩500 million.” This suggests that CEO Nam Myeong-yong’s compensation was below this disclosure threshold.

CEO Nam Myeong-yong’s prior criminal embezzlement case

Lumir is not without its own controversy. According to Korean reporting, Nam Myeong-yong was sentenced to a fine in a criminal case related embezzlement during his service as CEO of MijiLab, Co., Ltd.

Myeong-yong fully-owned MijiLab, which merged with Lumir on September 3, 2018. According to the report, CEO Nam Myeong-yong directed MijiLab pay ₩192 million to persons not employed by MijiLab, including his spouse. These persons renumerated the funds back to Myeong-yong. Myeong-yong used some of the money for entertainment expenses and foreign car payments. After being caught, Myeong-yong paid a ₩3 million fine for this embezzlement, and apparently donated ₩192 million back to Lumir.

Lumir outlook and risk assessment

Lumir’s future outlook appears precarious, underscored by a concerning financial trajectory and a questionable management track record. Despite a peak in losses in 2023, Lumir significantly missed its 2024 net income forecast, recording a loss instead of projected profit. This pattern of missed projections continued into Q1 2025 casting severe doubt on its ambitious 2025 revenue targets. Further compounding these financial concerns, Lumir’s backlog has steadily declined post-IPO, making its aggressive 2025 revenue forecast seem unattainable. This history of over-optimistic guidance, combined with revelations about CEO Nam Myeong-yong’s past embezzlement case, erodes investor confidence in management’s credibility and the company’s governance.

A significant risk stems from Lumir’s extreme customer concentration. Its space business relies almost entirely on the Korea Aerospace Research Institute (KARI), accounting for 93% of space-related revenue in both 2023 and 2024. Similarly, its marine product manufacturing segment, which comprises a quarter of total sales, is 100% reliant on HD Hyundai Heavy Industries. This leaves Lumir highly vulnerable to changes in demand or relationships with just two key customers. And a notable lack of marketing for its satellite products suggests little effort to diversify.

However, as a positive, Lumir has developed multiple satellite subsystems they manufacture in house. This is impressive and if managed and marketed well, could favorably position Lumir for the future. So far, does not look like it though. And the South Korean government is rapidly increasing its domestic spending on space, which also could position Lumir favorably.

Given its ongoing operational losses, declining backlog, and missed financial targets, Lumir almost certainly lacks the capital required to fund its ambitious plans for a SAR satellite constellation and factory build, making further dilutive financing or debt raises highly probable. And even once/if launched, the challenge remains for Lumir to break into overseas SAR data sales. This market is already dominated by established players like ICEYE, Capella Space, and Umbra Lab, with even Japanese counterparts like iQPS and Synspective struggling to secure foreign contracts. The combination of financial instability, extreme customer dependency, a questionable management track record, and formidable competition in its targeted global SAR market presents a high-risk profile for potential investors, despite the potential tailwind from growing domestic government spending.

What to look from Lumir

Here are five key points for investors to watch regarding Lumir’s future:

- Diversification of Customer Base: Lumir has satellite heritage and apparently invested significantly in developing multiple satellite subsystems. However, they only have one major buyer: KARI. Any significant new customer contracts outside of KARI for satellite products would be welcomed news. Lumir likely needs more than just domest growth in Korean space spending. Investors want to see broader market penetration.

- Progress in LumirX SAR Constellation Development and Commercialization: Key milestones include the successful development and launch of the first LumirX satellite in 2026. Crucially, investors should look for signs of success in securing commercial contracts for SAR imagery data, especially breaking into overseas markets where strong competitors like ICEYE, Capella Space, and Umbra Lab already dominate.

- Capital Sufficiency and Future Funding Rounds: Given Lumir’s significant R&D costs, manufacturing plans, upcoming launch costs, and current cash burn rate, investors should monitor the company’s cash reserves and any announcements regarding additional capital raises (debt or equity). A dilutive equity financing round would impact existing shareholders.

- Credibility of Management Guidance and Market Strategy: Lumir’s management has been inept at providing accurate guidance. And they apparently stopped providing financial guidance all together post IPO. Investors would be assured by Lumir beginning providing more reliable and consistent financial guidance. Additionally, look for concrete evidence of an active commercial sales strategy for its satellite products, beyond just investor relations, to demonstrate a genuine intent to address the lack of commercial demand.