| Market Cap: kr555.6M TTM revenue: kr206.5M YOY return: -5.23% |

CEO: Carsten Drachmann Cumulative pay: kr3.9M Shareholder value created: kr334.5M |

Forecast effort: F Forecast accuracy: F |

|

GOMspace is a cubesat satellite manufacturer headquartered in Denmark listed on the Stockholm NASDAQ. Offering full-builds, individual components, and satellite operation services, investors have endured a rocky run since GOMspace’s 2016 IPO. Failed business deals, missed forecasts, and repeated dilutions crushed investors since the stock peaked in 2017. Operating in a crowded cubesat market only makes prospects more difficult. But GOMspace may be finally finding a way. In 2023, new CEO Carsten Drachmann shifted focus from topline growth to profitability. While not there yet, GOMspace is edging closer. 2024 operating losses narrowed. A new contract for 20 satellites from Indonesia may seal the deal. But current margins and management forecasts suggests GOMspace will again not reach profitability in 2025.

2 Minute Version

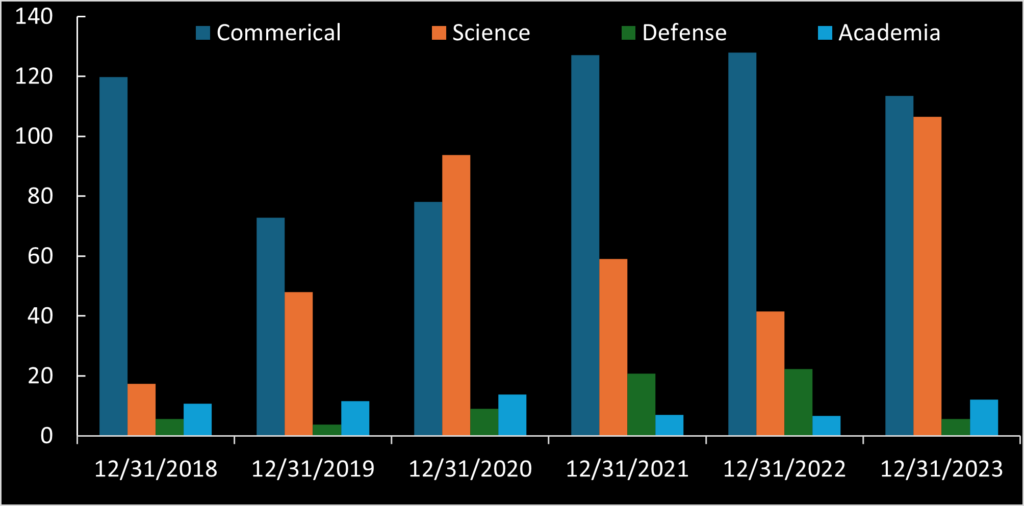

- GOMspace’s flight history dates to 2013 when GOMX-1 (2U size) successfully deployed into low earth orbit. GOMspace now offers CubeSat platforms and internal components with extensive heritage. Such flight heritage is sought by government and academic customers who comprised over half of GOMspace’s sales in 2023. (2024 data not available.)

- GOMspace went public in June 2016 following three years of 81% revenue CAGR. Shortly afterward GOMspace announced investment in Aerial & Maritime Ltd, a GOMspace subsidiary registered in Mauritius. GOMspace pitched investors that A&M would buy satellites from GOMspace to service Africa with air traffic monitoring services.

- GOMspace followed-up in February 2017 announcing the Sky and Space Global (UK) Ltd satellite constellation contract valued at €35-55M. The stock advanced 60% on the news.

- All looked great in April 2017 when GOMspace issued its FY16 annual report with net profit of SEK 8.9M (~$860k). However, it was not as it seemed. GOMspace actually incurred an operating loss. Net profit stemmed from recording a SEK 21.3M investment gain on (47.3%-owned) subsidiary A&M. GOMspace stock peaked that September at SEK 69 per share.

- Things unraveled and GOMspace stock would loose as much as 98% of its value.

- The A&M venture went nowhere. The satellites did not launch, A&M shutdown, and in 2020/21 GOMspace wrote down this investment to zero.

- The crash of the Sky and Space Global satellite constellation contract followed. In April 2020 Sky and Space filed for voluntary administration. And the next year Sky and Space delisted from the Australian Stock Exchange.

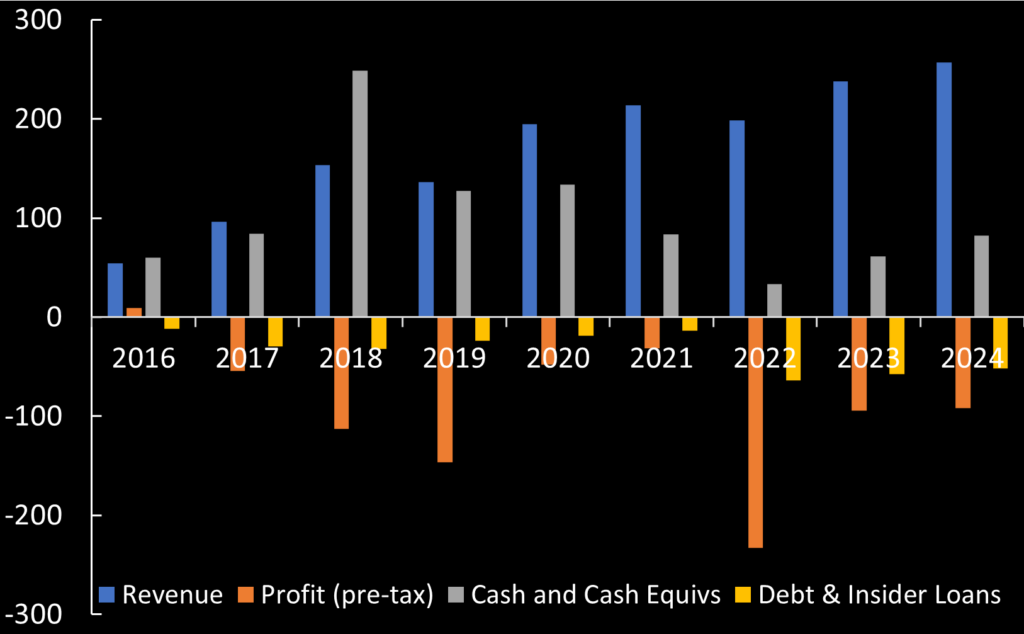

- Somehow GOMspace still managed six years of 35% revenue CAGR through 2021. But the write-offs caught up to GOMspace in 2022 resulting a huge losses. Layoffs and dilutive capital raises followed.

- In late 2022, GOMspace experienced a well-publicized falling-out with remaining commercial Spanish customer Startical. After Startical cancelled its contract, former CEO Niels Buus resigned. That year GOMspace also failed obtaining a then-promising ESA contract.

- In March 2023, during a historic low point, GOMspace appointed Carsten Drachmann CEO. Drachmann wrote to investors that, “Unlike focusing solely on top-line growth and technology projects with uncertain profitability, our goal is sustainable profitability. We’ve scrapped unprofitable projects and assessed all decisions based on their cash impact.”

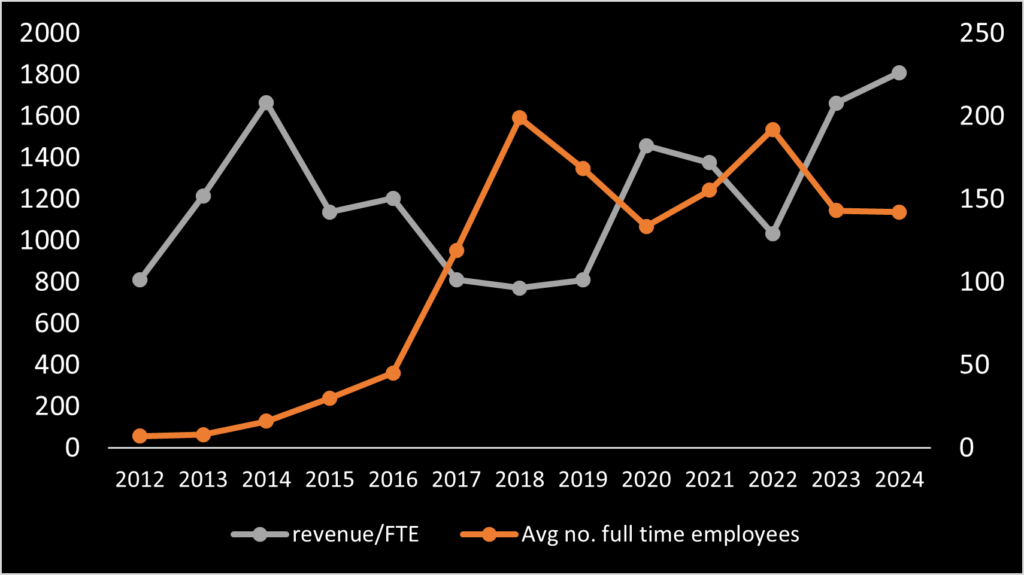

- After CEO Drachmann, GOMspace won back Startical. And GOMspace closed narrowing losses in each FY23 and FY24. Revenue also grew to record levels each year. And more significantly GOMspace achieved the highest revenue-to-employee ratio in its history. GOMspace appears operating more efficiently than ever. (original research)

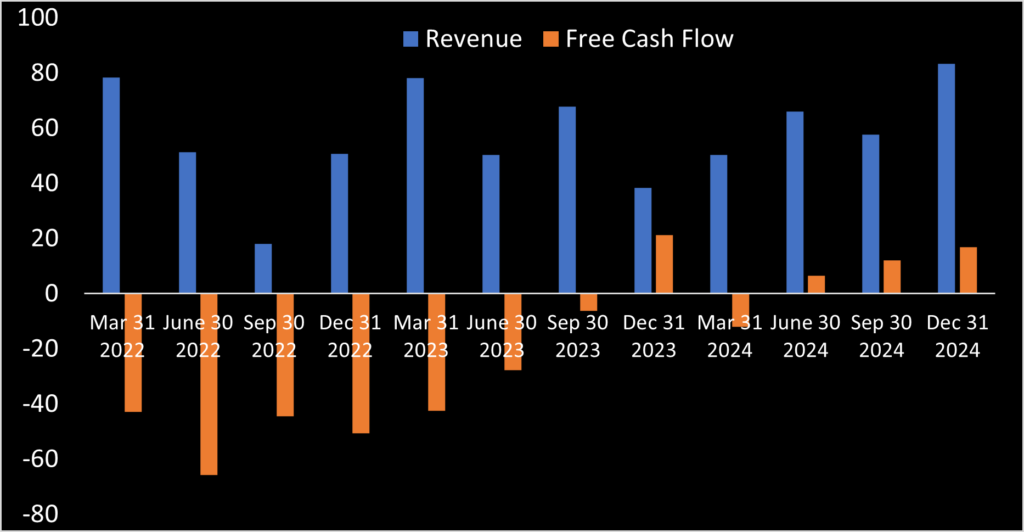

- GOMspace forecasted reaching cash flow positive in the second half of 2024 and hit it. Legitimate prospect exists for GOMspace reaching operational profitability. However, current margins and management-forecasted revenue growth do not suggest profitability in 2025.

- GOMspace stock jumped 3x in December 2023 on news of a 20-satellite contract with the Indonesian government. Financing over a year later remains unconfirmed. Expected revenue to GOMspace from this deal totals €59M representing almost over two times total FY24 revenue!

- Unlike earth satellite imagery providers, Asia currently has practically zero CubeSat competition. GOMspace’s labor costs are likely smaller than American firms with larger market presence (Terran Orbital’s Tyvak and Blue Canyon). So if GOMspace achieves profitability, a promising path exists for mid- or long-term competitiveness.

Examining Financial Disclosures

GOMspace went public in June 2016 after 3 years of 81% compound annual revenue growth. Contracted to build voluminous satellites for two large customers – Aerial & Maritime and Sky and Space Global – sustained growth and profitability appeared assured. Both projects collapsed. GOMspace instead experienced write-downs, lay-offs, and approximately 10x shareholder dilution!

Revenue growth has largely stalled since 2020. There are multiple reasons, including (1) Statical terminating its large contract in 2022, (2) ESA not continuing a major project, and (3) GOMspace cancelling unprofitable customer contracts to focus on positive cash flow.

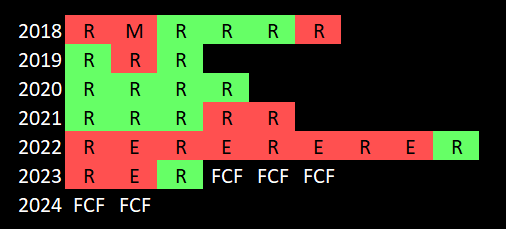

GOMspace’s most recent cash raise (and 120%+ dilution!) was in 2023. The announced another stock sale with approximately 17% dilution in March 2025. New CEO Carsten Drachmann since 2023 has targeted (and reiterated) positive free cashflow as his goal. GOMspace posted positive free cash flow in 4Q 2023, but again in for three quarters in 2024.

Drachmann wrote in his 2024 Q1 summary that the last unprofitable project he inherited is the ESA Hera asteroid Juventas CubeSat mission. Its negative impact on GOMspace’s earnings will diminish by the end of 2024. The elimination of this final unprofitable contract likely contributed to GOMspace reaching cashflow positive in 2H 2024 as targeted.

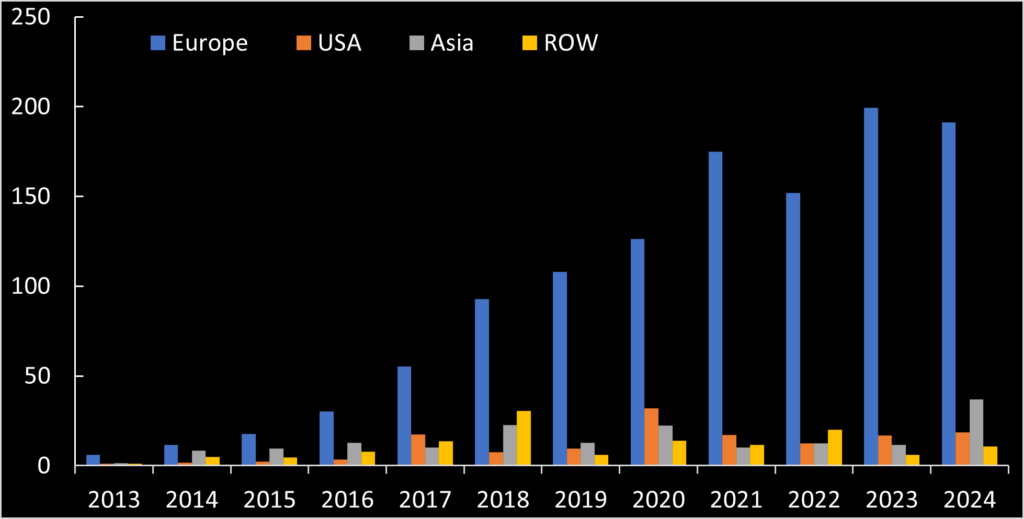

Earlier in GOMspace’s history, regional revenue was more evenly distributed. Now Europe dominates sales. The Indonesian contract in this context appears out of nowhere. This suggests GOMspace is reaching and competing in markets with little current presence. Significantly, US sales – the world’s largest satellite market – made up 16% in 2020 but slid to 7% in 2024. Low US sales arguably could be viewed positively. GOMspace winning future US deals provides realistic growth opportunity (because their sales currently are so low there). Export control rules prohibit certain U.S. payloads from shipping to Denmark for satellite integration. So GOMspace partnered with SAIC (U.S. government contractor) apparently to alleviate this issue. Under this partnership, GOMspace provides satellites “kits” to SAIC and SAIC assembles satellites and payloads in the US. This has not resulted in big revenue gains. But it shows GOMspace is still seriously eying the U.S. market.

Somehow GOMspace exhibits something not commonly seen among space companies: commercial sales being largest revenue contributor. Part may be due from operating in the CubeSat space. Many commercial companies first test payloads and mission capabilities in CubeSats before proceeding with larger satellites. But compare this to Terran Orbital or Blue Canyon whose revenue is predominately government. GOMspace’s ability to compete commercially appears to reflect pricing competitiveness.

Science sales (read “sales to ESA”) drove FY23 revenue to record levels. As already noted, CEO Drachmann highlighted one ESA project as unprofitable. So don’t be surprised if Science sales decline in future years as GOMspace shifts from taking on unprofitable contracts.

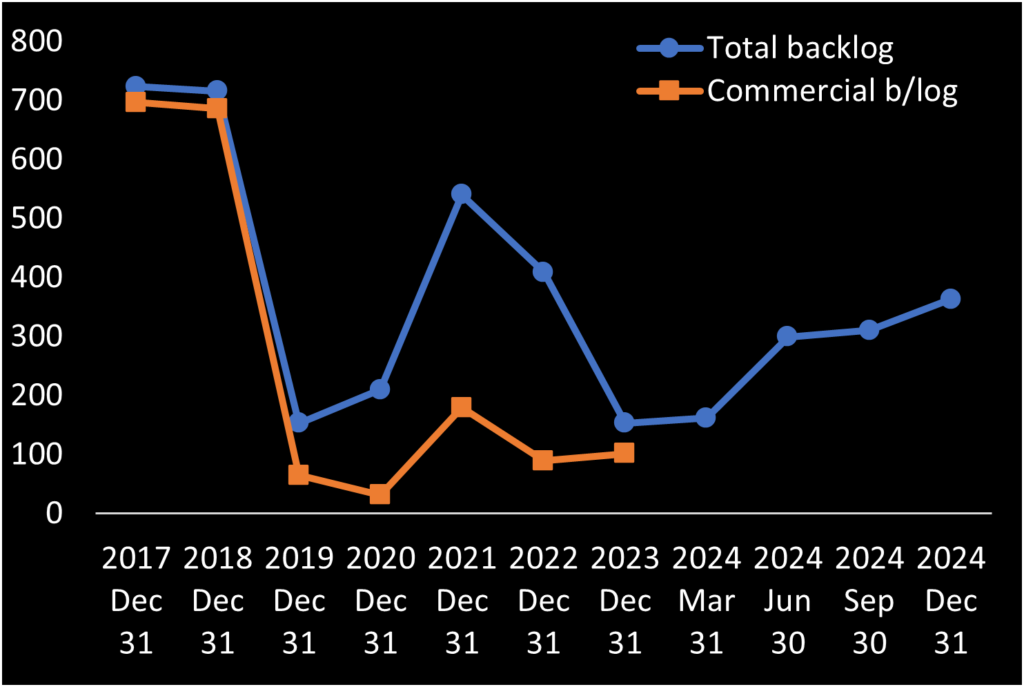

GOMspace’s backlog history in a way tells the history of the company. GOMspace’s backlog once rode on the A&M and Sky and Space Global deals. Their collapse took down GOMspace’s backlog. GOMspace regrew its backlog a second time, then predominately from non-commercial sources. GOMspace later disclosed these projects to be unprofitable and cut them in 2023. GOMspace ended 2023 with SEK 153 million in backlog, amongst the lowest in its history as a public company. But one year later, this grew to SEK 363 million.

Backlog does not account for the Indonesian contract which as of writing remains unsigned. If signed, it will add an additional SEK 653 million to backlog. This is equal to more than two years worth of current revenue.

GOMspace consistently discloses the average number of yearly employees. As detailed in their reports, GOMspace previously ramped hiring anticipating need to execute prior large projects (A&M, Sky and Space Global, Startical). When these failed to materialize (or in the case of Statical, was cancelled the first time) GOMspace laid off unneeded employees. In FY24GOMspace finished the year with the largest revenue-per-employee ratio in its history. By this metric, GOMspace is operating twice as efficiently than in 2017-2019. This helps evidence how GOMspace met its positive cashflow target in 2024.

Management guidance scorecard

GOMspace has provided investors a lot of guidance that it missed. Admittedly, all misses occurred under watch prior CEO Niels Buus.

But after taking over, new CEO Carsten Drachmann stopped providing revenue and EBIT guidance. For a year and a half, Drachmann has been telling investors GOMspace aims to reach positive free cash flow in the second half 2024. I don’t like this lack of effort. Investors want public companies to clearly communicate expectations for revenue and internal costs (measured by EBITDA) in order to make informed decisions. GOMspace all but certainly has internal forecasts. Even if profitability has become main focus, the lack of revenue and EBIT forecasts hints that GOMspace may lack confidence in its own projections.

CEO Carsten Drachmann compensation

| Salary | Bonus | Share-based payments | Other | Total | |

|---|---|---|---|---|---|

| 2023 | SEK 2,880,000 | SEK 795,000 | SEK 57,000 | SEK 150,000 | SEK 3,882,000 |

In 2023, the year he came on board, GOMspace paid CEO Carsten Drachmann a modest SEK 3.9M (~$370,000) to turn the company around. Whether he turns the company around remains to be seen. But the stock has turned around, up over 300% since when Drachmann started.

GOMspace outlook and risk assessment

GOMspace appears to be on the path to positive free cash flow and profitability. And the announced 20-satellites sale to Indonesia could double yearly revenue. Also:

- GOMspace’s largest CubeSat competitors are Nanoavionics, EnduroSat, Spire Global, AAC Clyde and Terran Orbital’s Tyvak. Nanoavionics and EnduroSat likely enjoy lower operating costs due to manufacturing in Lithuania and Bulgaria, respectively. (Spire Global is based in the United States but they assemble satellites in Glasgow, UK. AAC Clyde also manufactures in the UK; Tyvak CubeSats are made in the U.S. and Italy.)

- There is almost zero current CubeSat competition from Asian manufactures. But this is changing. Nothing yet in Japan. But Rapidtek in Taiwan announced development of low cost CubeSats (already experienced in manufacturing smallsat antennas). Nara Space in South Korea began selling 6U-16U cubesats after launching its first successful satellite. The prices still need to comedown before competitors sweat, likely because Nara Space buys components from GOMspace for its builds! It takes years to independently develop all power, communication, attitude & orbit control, software systems. Thus GOMspace should have plenty of cushion before cheaper competition from Asia becomes threatening.

- The market is growing. First-time SmallSat operators reached all time high of approximately 140 in 2023. This trend is promising for GOMspace and all other CubeSat manufactures.

- Obviously lack of profitability 8 years post-IPO is concerning. However, it really looks this streak may come to an end. And if so, GOMspace will be one of the few profitable new space companies.

Seemingly not as risky as many other space stocks, but GOMspace still yet to prove operational profitability. But they are close.

What to look from GOMspace going forward

In future GOMspace investor disclosures, look for the following:

- Finalization of the 20 satellite sale to Indonesia. The Danish government is guaranteeing the financing and reported in June that final approval is on track for the end of third quarter 2024. If this project collapses, expect GOMspace stock to also retreat toward December values.

- GOMspace targets 25 to 48% revenue growth in 2025. And this growth does not assume Indonesia closes. Even with 48% growth at current margins, the math does not suggest GOMspace can reach profitability. So waiting to better forecast if profitability is within reach in 2026.

- Growth in U.S. sales. Opportunity here is huge. GOMspace has a U.S. office and its partnership with SAIC allows for stateside satellite assembly. But investors are still waiting to see if GOMspace manages any secure any significant U.S. business as a result.

Recent News

-

ImageSat 2025 1Q results: steep net loss, sales challenges

ImageSat International (TLV: ISI) had a tough 2025 first quarter, posting its largest net quarterly loss since going public three years ago. A quarter-on-quarter drop…

-

GOMSpace Q1 profitable on record Q1 revenue; North American growth lags

GOMspace (STO: GOMX) became the second publicly traded small satellite manufacturer to report a profitable quarter. The first quarter of 2025 saw profit of SEK…

-

GOMspace narrows 2024 operating loss; new capital coming

GOMspace (STO: GOMX) reported 2024 financials, raised new capital from its largest investor, and previewed 2025 1Q sales progress. In 2024 Q4 GOMspace posted record…

-

GOMspace CEO Carsten Drachmann video presentation; BOD member Henrik Kølle buys more shares

Carsten Drachmann is the hero of GOMspace. Do this exercise: first listen to Marc Bell talk about Terran Orbital for ten minutes. Any prior interview,…

-

GOMspace insider and professional investor Henrik Kølle buying more GOMX stock

GOMspace (STO: GOMX) board member Henrik Kølle purchased more shares of GOMspace stock. Whereas insider selling is more the norm, this represents a relatively rare…

-

GOMspace 3Q financial results; Indonesia status unchanged

GOMSpace’s just released 2024 third quarter financial results indicate CEO Carsten Drachmann’s business turnaround strategy is on track. Over the past three years, quarterly revenue…