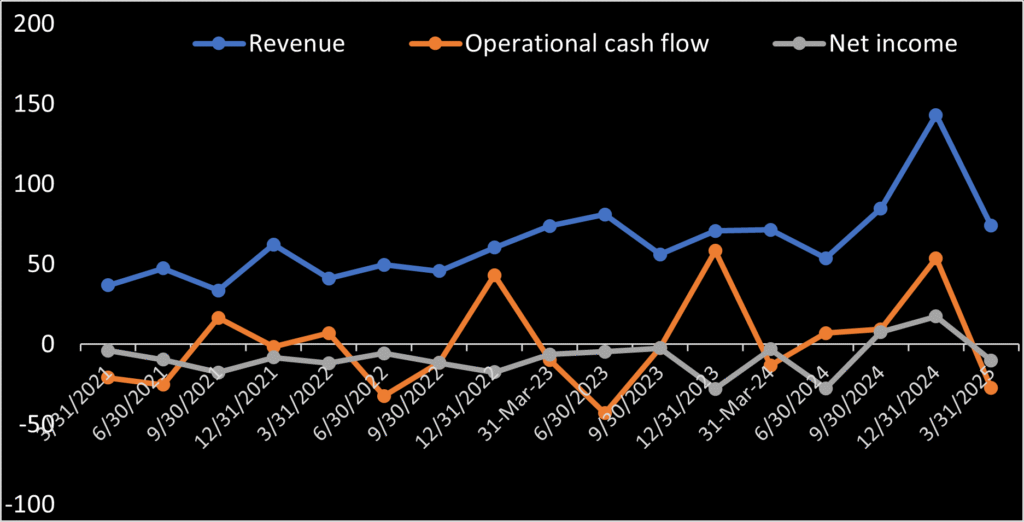

After two consecutive profitable quarters to close out 2024, AAC Clyde (STO: AAC) reported disappointing first-quarter 2025 financial results. Revenue of SEK 74.0 million represented a 48% quarter-on-quarter decrease, and negative operating cash flow of SEK -27.3 million was the worst since the second quarter of 2023. This breaks AAC Clyde’s two quarter streak of profitability.

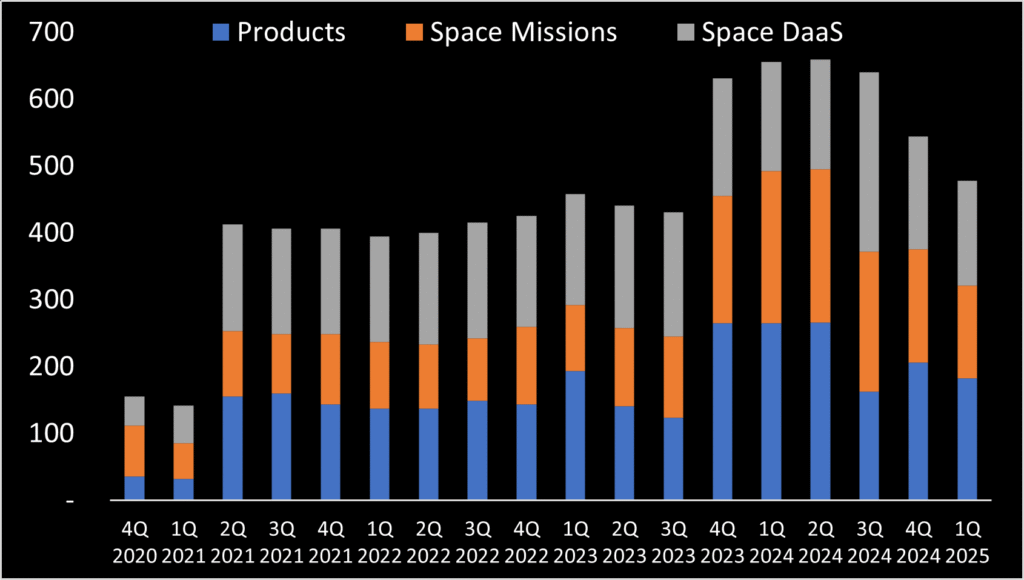

Total backlog also decreased from a record high of SEK 659 million last year to SEK 478 million as of March 31, 2025, suggesting potential difficulties in securing new orders. CEO Luis Gomes noted in his letter to investors that “The decrease in Missions backlog reflects a broader market shift away from the smallest satellite formats — a trend we have anticipated and prepared for,” implying a decline in market demand for cubesats, historically a primary revenue source for AAC Clyde.

Gomes further stated, “It reinforces our strategic focus on growing Data & Services and strengthening our Products offering.” However, the potential award of the EPS-Sterna contract, reportedly exceeding €73 million (SEK 796 million), could nearly triple AAC Clyde’s backlog. Gomes also referenced Sterna in his letter.

AAC Clyde also announced a merging of its revenue segments. Starting next quarter, Products (selling individual satellite parts) and Space Mission (selling full satellites) will be combined into a single revenue segment. This consolidation obscures revenue sources and could be interpreted as AAC Clyde downplaying the Space Mission segment’s potential decline by merging it with the Products segment.

Despite disappointing Q1 results, Luis Gomes maintained a positive outlook, stating, “Supported by strong revenue visibility and despite expected short-term variations, our full-year outlook remains unchanged: we continue to target double-digit net sales growth, positive EBITDA, and sustained positive cash flow from operating activities.” Following the release of the Q1 results, AAC Clyde’s stock fell approximately 18% the morning of trading. If Gomes’ full-year guidance proves accurate, this decline could present a opportunity. According to our count, since 2023, AAC Clyde has met its guidance 14 out of 21 times (67%).