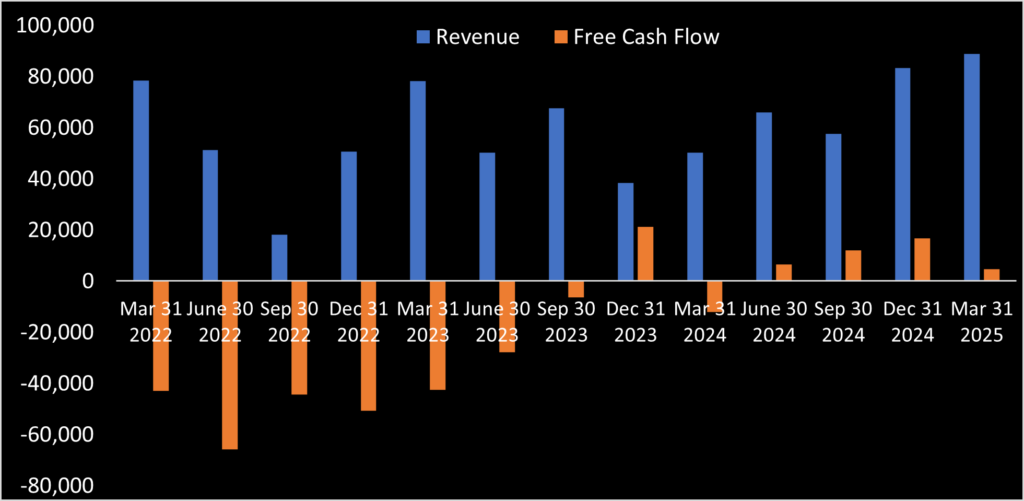

GOMspace (STO: GOMX) became the second publicly traded small satellite manufacturer to report a profitable quarter. The first quarter of 2025 saw profit of SEK 1.3m on record revenue of SEK 88.8m, or approximately $135,000 profit on $9.2 million revenue. Notably, Q1 also marked the fourth consecutive quarter of positive free cash flow. Following this news, GOMX stock jumped 22%.

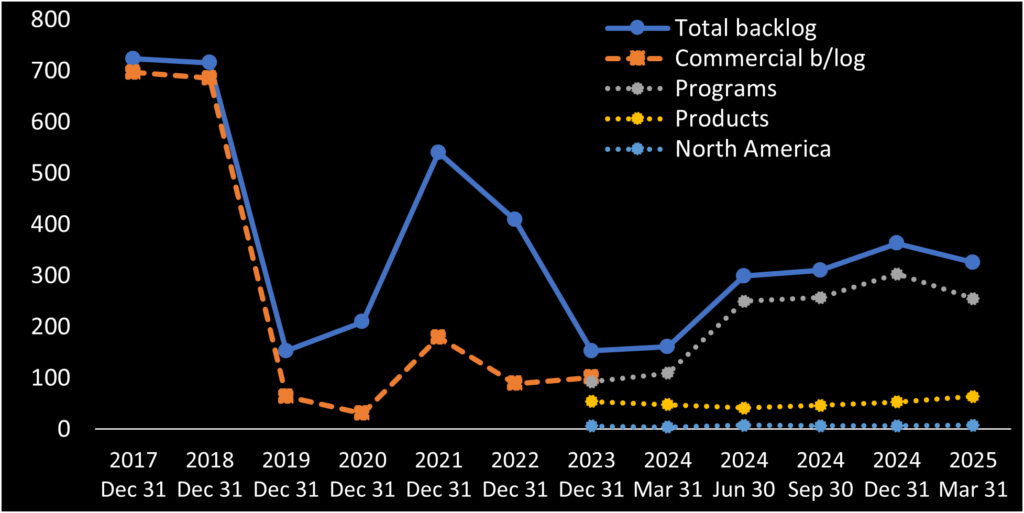

Since 2024, GOMX has reported revenue across three business segments: Programs, Products, and North America. (This represents a shift from earlier years when segments were defined as Commercial, Science, Defense, and Academia.) CEO Carsten Drachmann’s stated objective since 2023 has been to broaden sales in North America. However, this still appears to be a work in progress. North American sales accounted for 8.5% of total revenue in Q1 2025, a decrease from 13.2% in Q1 2024. Furthermore, backlog figures indicate that the North American business contributes only 2.2% of the current backlog, while the Programs segment continues to drive overall backlog growth, which has doubled since 2023.

Comparison to AAC Clyde

This new segmented reporting allows for a more direct comparison with competitor AAC Clyde Space. In its most recently reported quarter (Q4 2024), AAC Clyde posted SEK 51.8 million in revenue with SEK 7.4 million in EBITDA (14.2%) for its Missions segment. GOMX, in its Programs segment for Q1 2025, reported SEK 49.1 million in revenue with SEK 5.2 million in adjusted EBITDA (10.6%). Both AAC Clyde’s Missions and GOMX’s Programs segment encompass the delivery of complete satellite builds to customers. Both GOMspace and AAC Clyde have similar revenue levels and margins in this segment.

Comparing the Products segment for both companies is slightly more complex. GOMX posted SEK 5.8 million in adjusted EBITDA on SEK 32.1 million in segment revenue (18.1%). In Q4 2024, AAC Clyde reported SEK 26.7 million in EBITDA on SEK 56.4 million in revenue (47.3%). While this on face appears significantly better for AAC Clyde, their Q4 2024 results included SEK 19.5 million in licensing revenue, which was likely pure EBITDA. Excluding this licensing revenue leaves AAC Clyde with SEK 7.2 million in EBITDA on SEK 36.9 million in revenue (19.5%). Thus it appears GOMspace and AAC Clyde exhibit remarkably comparable margins in both Products and Programs/Missions segments.

Despite similar revenue and margin levels, AAC Clyde still appears comparatively undervalued with a market cap of approximately SEK 530 million. GOMspace’s market cap is approximately SEK 1.4 billion.