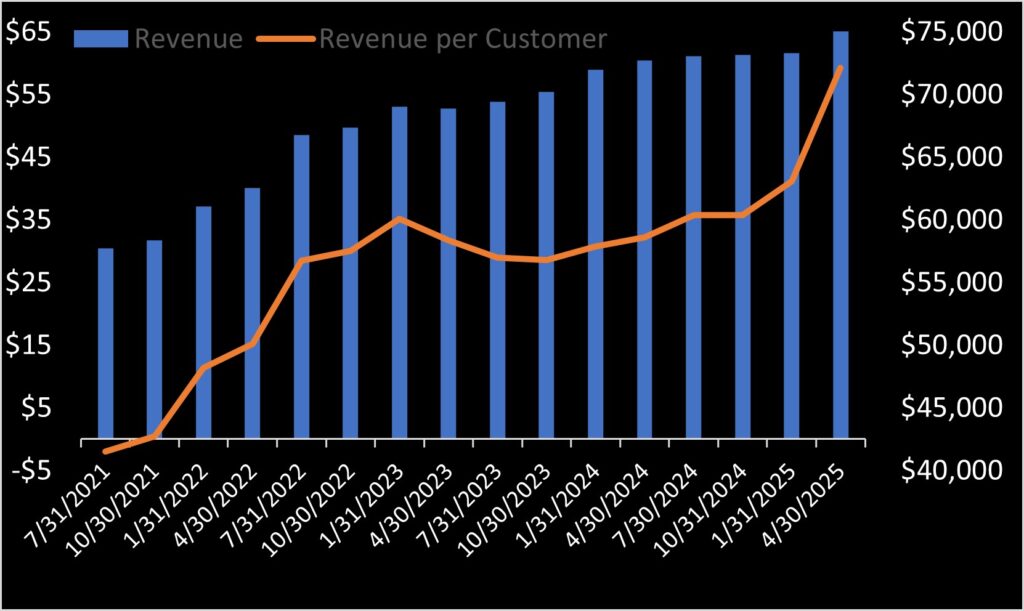

Planet Labs (NYSE: PL) reported strong performance in its fiscal year 2026 Q1, which ended on April 30, 2025. After two consecutive quarters of no growth, revenue increased quarter-on-quarter from $61.6 to $66.3 million. More significantly, Planet Labs received a large number of customer pre-payments, resulting in $17.3 million positive operational cash flow. While Planet’s customer count continues to slightly decrease, the data suggests that those lost are primarily low-revenue customers.

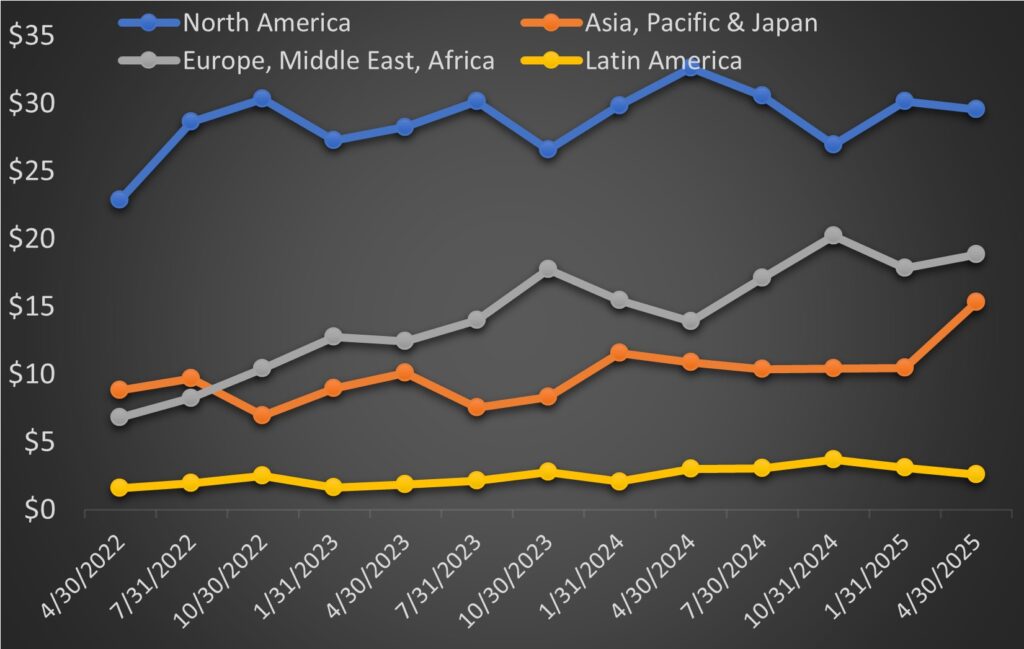

Planet’s revenue increase appears driven by growth in Asian sales. CEO Will Marshall similarly noted on this quarter’s conference call, stating, “We’re feeling it in Asia.” It might be tempting to link this revenue directly to the recently announced $230 million sale to SKY Perfect JSAT in Japan. However, Planet Labs is not scheduled to deliver any Pelican satellites under this contract until 2027, which suggests current revenue may stem from other Asian customers.

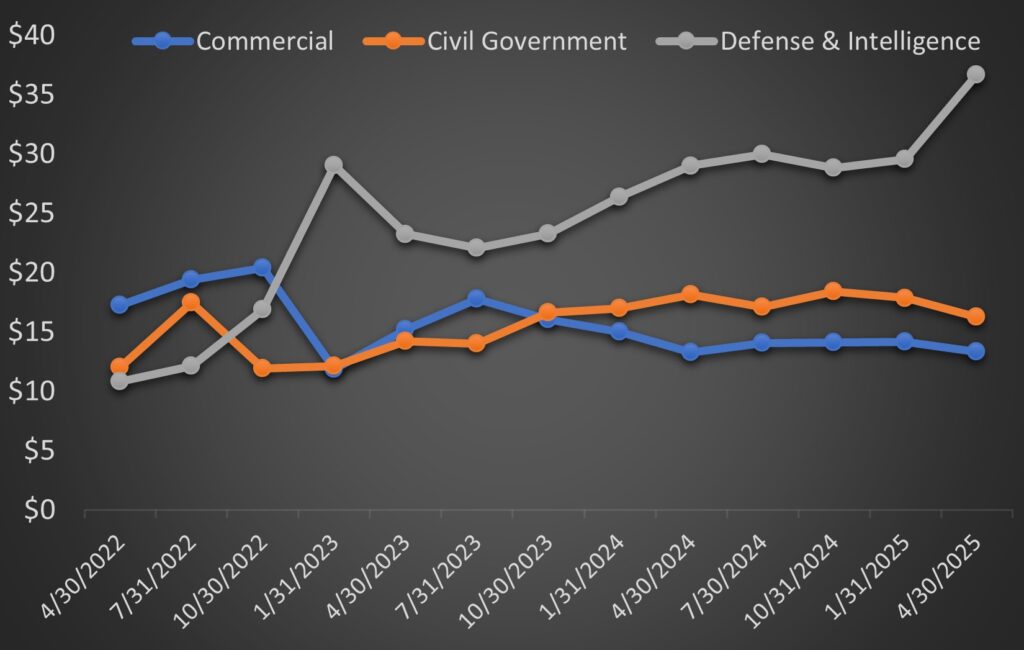

The increase in revenue may very well originate from an Asian Defense and Intelligence sector government customer. Comparative level of quarterly revenue growth in the Defense and Intelligence segment supports such conjecture. Defense and Intelligence revenue now represents a record 55% of Planet’s total revenue. CFO Ashley Johnson reinforced this trend, stating, “we continue to see strong demand emerging in the DNI sector.” In contrast, commercial revenue now comprises just 20% of Planet’s revenue. In fact, the entirety of Planet Labs’ revenue growth since November 2023 is attributable to the Defense and Intelligence sector.

A review of Planet’s Cash Flow statement reveals a significant inflow of deferred revenue totaling $44.1 million. This represents cash received for services or products not yet delivered. These may represent prepayments SKY Perfect JSAT made for ordered Pelican satellites. This substantial cash influx was the primary driver of the positive operating cash flow Planet achieved last quarter. Planet generated $17.3 million in cash from operations, a significant shift from negative to positive. While this is a very good sign if sustainable, caution that it may be a one-time event related to the SKY Perfect JSAT contract.

Finally, Planet continues to shed customers. However, given that the average spend per customer is increasing, this suggests that the customers leaving are those with lower revenue contributions. Planet Labs reported 976 total customers at quarter’s end. But just three customers account for a significant portion of Planet’s business. Planet stated in its quarterly SEC filings, “For the three months ended April 30, 2025, three customers accounted for 16%, 14%, and 11% of revenue, respectively.” This means these three customers contributed an average of $9 million in revenue, while the remaining 973 customers averaged just $40,000 each.

Buyers reacted favorably to these quarterly results. The stock rose 52% the next following this news.