| Market Cap: $175.6M TTM revenue: $67.7M YOY return: +255.29% |

CEO: Nir Barkan Cumulative pay: $2.1M (est) Shareholder value created: $137.1M |

Forecast effort: F Forecast accuracy: F |

|

SatixFy is a fabless manufacturer of integrated circuits designed to control antennas in both space and ground-based applications. Traditional parabolic antennas rely on motors and gears to physically reorient the pointed beam. In contrast, electronically steerable phased array antennas can change direction almost instantaneously without mechanical movement. They also possess the capability to form beams pointing in multiple directions simultaneously. Utilization of phased array antennas is increasing in Low Earth Orbit (LEO) satellites and ground-based antennas used for satellite communication. SatixFy designs and markets the chips that control these advanced antennas. However, SatixFy’s business appears heavily concentrated on contracts related to Telesat’s Lightspeed constellation.

SatixFy went public in October 2022 after publishing a financial model that projected significant revenue growth of $10 million to $80 million between 2022 and 2024. This growth did not materialize. Actual revenue remained stagnant at $10.6 million from 2020 to 2022 and increased only to $19 million in 2024. Since its public listing, SatixFy has not announced any significant new customers, likely explaining stalled growth. This lack of revenue growth has also been reflected in SatixFy’s stock performance, which has lost 80% of its value since going public. SatixFy is based in Israel and trades on the New York Stock Exchange.

2 Minute Version

- SatixFy primarily designs and markets chipsets that control satellite and ground antennas. Lacking its own manufacturing fabrication facility, SatixFy predominantly contracts chip manufacturing to GlobalFoundries.

- SatixFy went public via a SPAC merger in October 2022, with the aim of achieving positive adjusted EBITDA and cash flow within two years. SatixFy never met this target.

- SatixFy touted that its SPAC would raise up to $350 million in gross proceeds, assuming no trust redemptions. However, the SPAC transaction proved disappointing. SatixFy merged with Endurance Acquisition Corp., whose trust account held $201.3 million prior to the merger. Endurance investors overwhelmingly opted to redeem their shares for cash instead of receiving SatixFy shares. SatixFy described this as a “substantial amount of redemptions.” Consequently, the $201.3 million held in Endurance’s trust dwindled to a mere $406,000 in cash for SatixFy post-transaction.

- Ever since, SatixFy has been treading water. They have announced three key customers who appear to comprise the majority of their revenue: MDA, Lightspeed, and an unnamed customer. However, revenue has never recovered to its $20.7 million peak posted in 2021.

- SatixFy’s current and future revenue appears heavily reliant on Telesat’s Lightspeed constellation. MDA, the satellite manufacturer for Lightspeed, utilizes SatixFy chipsets for digital beamforming. MDA also licenses modem and beamforming software from SatixFy. Additionally, SatixFy contracted directly with Telesat to provide ground-based baseband units that process data transmitted to and from the constellation.

- SatixFy also targeted the OneWeb constellation. OneWeb’s first-generation satellites used competitor antennas with steerable spot beams. In a next-generation technology demonstration satellite (“JoeySat“), OneWeb tested SatixFy’s multibeam phased array antenna and payload processor.

- Facing a cash shortage, SatixFy negotiated a significant prepayment from MDA, apparently to bolster its operating cash position. This situation is reminiscent of the agreement Mynaric was negotiating with its customer to unlock prepayments before filing for restructuring.

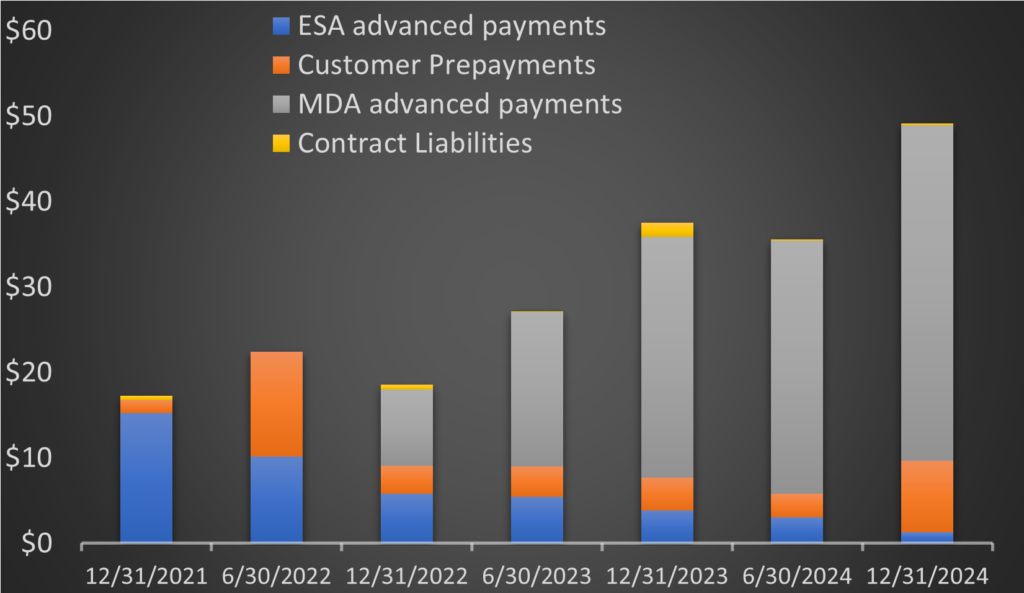

- Advanced payments from all customers currently stand at $35.6 million, an amount nearly two times its trailing twelve-month (TTM) revenue. Notably, 92% of these advanced payments are attributed to MDA and the ESA, suggesting a severe lack of customer diversification (original research).

- MDA announced in April its offer to buy SatixFy for $2.10 per share.

Financial Disclosures

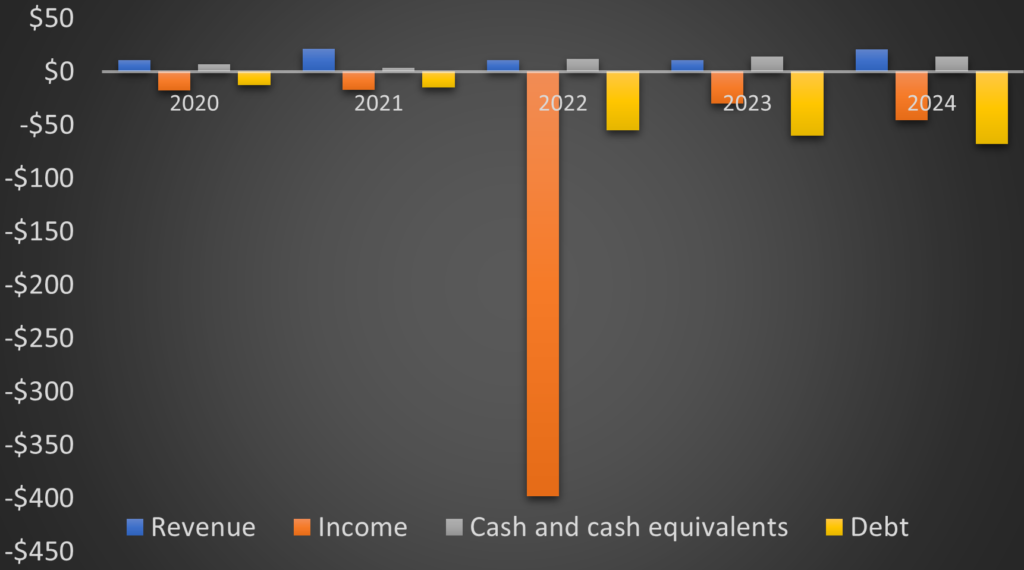

SatixFy’s main annual financial metrics reveal a company with stagnant revenue and increasing debt. SatixFy went public via a SPAC in October 2022, a transaction that was not financially successful. Many SPAC investors redeemed shares, opting for cash and declining to invest in SatixFy. Consequently, SatixFy did not experience a significant cash infusion from its public listing. (Contrast with Planet Labs and Satellogic, both had highly successful SPAC mergers.) The large negative income in 2022 represents a one-time loss related to the SPAC event. Operating losses (detailed further below) indicate that 2022 did not otherwise incur exceptional business losses. Revenue lacks sustained growth, increasing from $10.6 million in 2020 to $21.7 million in 2021 but then falling to $10.6 million and $10.7 million in 2022 and 2023, respectively. SatixFy did post near all-time high $20.7 million in revenue in 2024.

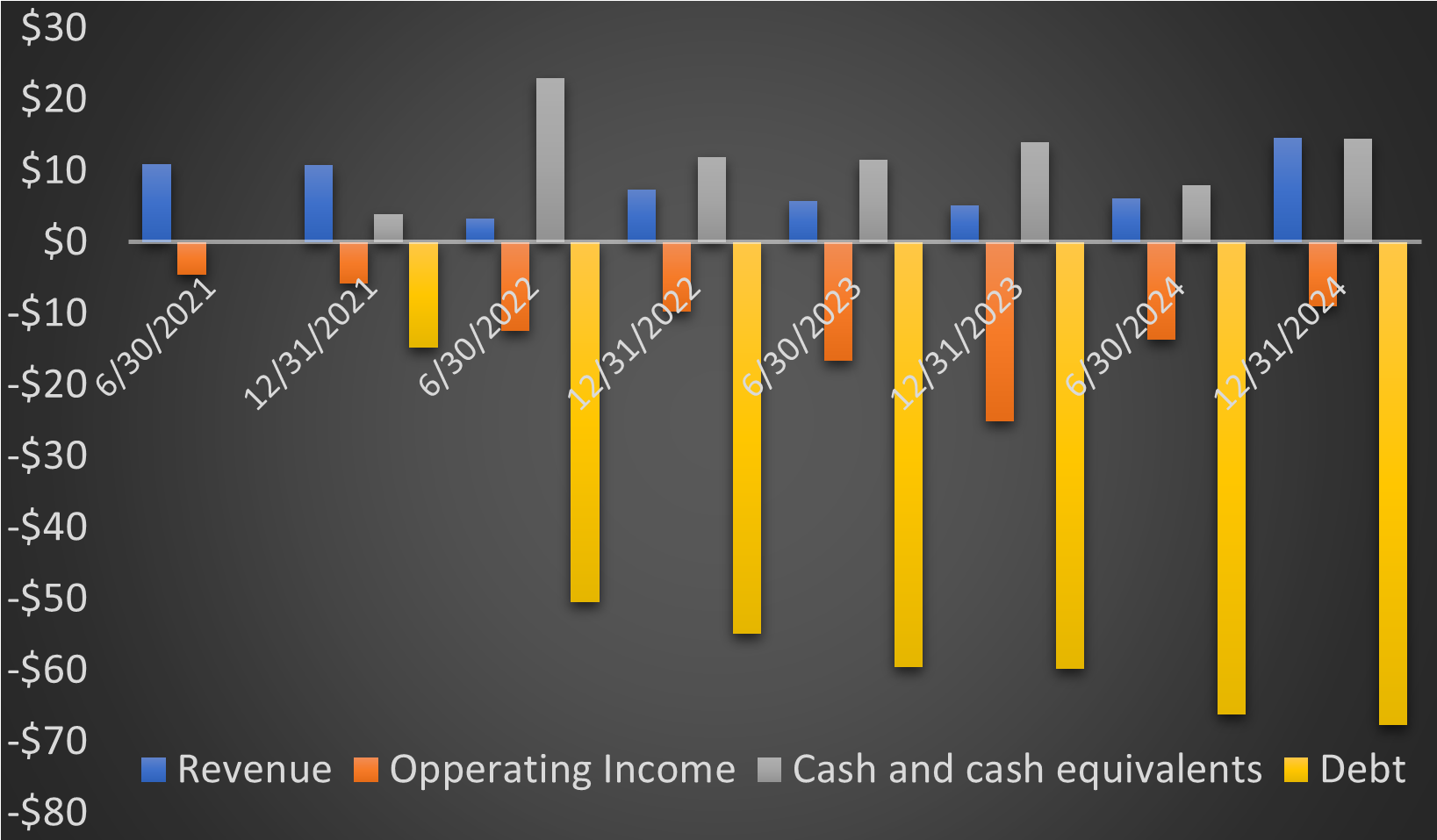

As a foreign issuer, SatixFy only files financial reports semi-annually. The company took on substantial debt prior to its public offering, presumably anticipating repayment with the SPAC proceeds. However, the unsuccessful SPAC left SatixFy post-IPO with no large cash influx and increased debt. Faced with stagnant revenue, SatixFy has funded operations through (1) increasing debt, (2) the sale of its UK business unit, and (3) customer prepayments. Severely short on cash, and with debt already exceeding five times its annual revenue, SatixFy likely faces challenges in obtaining favorable financing.

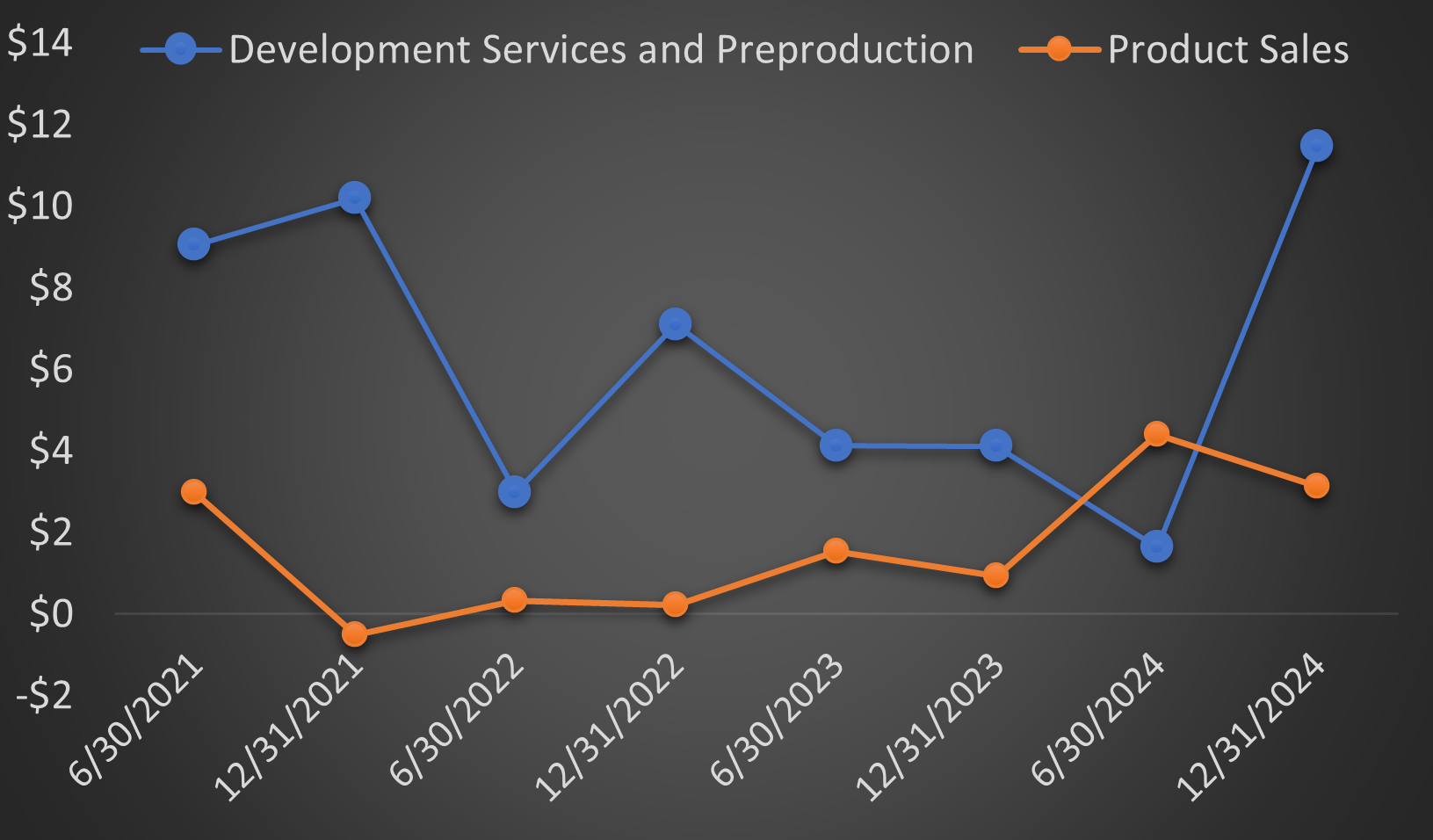

SatixFy disaggregates its revenue into product sales and product development services. Since July 2021, the company has recognized $50.7 million in revenue from product development, while only $13 million in revenue over this four-year period came from product sales.

SatixFy has received significant prepayments, primarily from MDA and the ESA. Three key points emerge: (1) If SatixFy fulfills deliveries for these orders (whether for development services or products), substantial annual revenue increase may be forthcoming. (2) However, SatixFy needs cash. If the cash from upcoming revenue is already prepaid, recognizing this revenue will not alleviate SatixFy’s cash position. The company needs to either secure more customer prepayments or identify another source of cash. (3) If the composition of current prepayments is indicative of SatixFy’s current customer base, then SatixFy has significant customer concentration with MDA. MDA-associated prepayments account for 80% of total prepayments. MDA is the prime contractor for Telesat’s Lightspeed satellite constellation. SatixFy separately contracted with Telesat to supply hardware for ground stations. This data suggests that SatixFy’s business is significantly concentrated on the Lightspeed project.

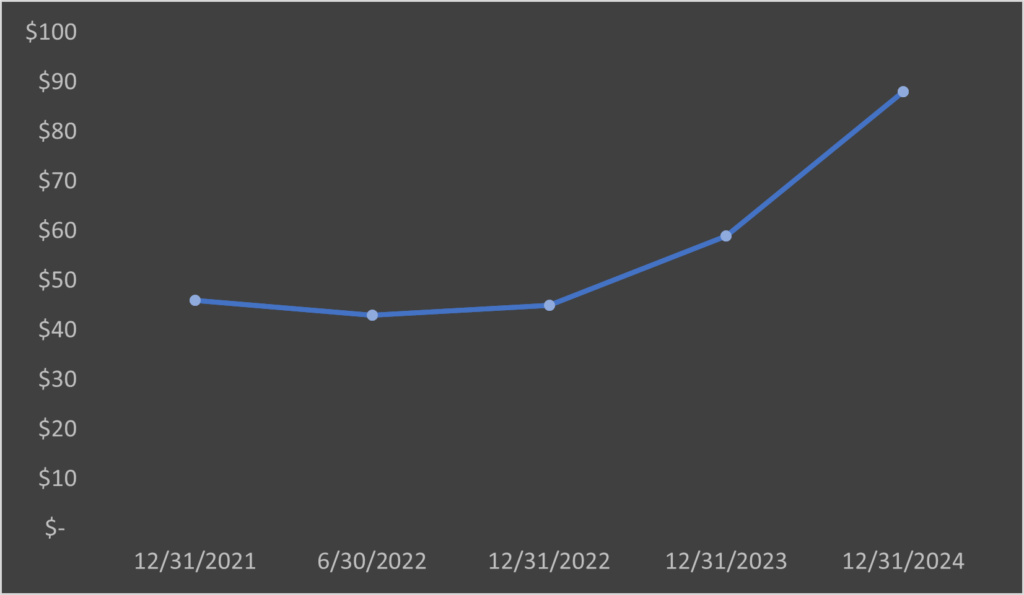

Finally, backlog has grown since 2021. As of December 2024, the most recent reported date for backlog, it stood at $88 million. However, SatixFy already holds $49.1 million in customer prepayments. Therefore, the amount of cash to be realized from the outstanding backlog may be around just $39 million.

Business, customers and competition

SatixFy’s business centers around supplying antennas to communication constellation satellites. They also provide ground-based antennas and related hardware for satellite connectivity. Given this focus, one-off satellite projects are unlikely to be major revenue drivers, explaining SatixFy’s pursuit of constellation customers. Orders from such customers would involve deploying SatixFy hardware and software on hundreds of satellites.

A recent SatixFy conference presentation indicates they are tracking major telecommunication constellations: Starlink, OneWeb, Lightspeed, Kuiper, IRIS2, and Galaxy Space. This list likely represents SatixFy’s largest potential antenna revenue sources. However, Starlink and Kuiper each manufacture their own antennas. Galaxy Space is China-based, with its antenna supply apparently secured, and export controls would likely prohibit technology transfer anyway. SatixFy is already positioned to supply Lightspeed through its partnership with MDA. This leaves OneWeb and IRIS2 as key targets.

SatixFy has already supplied beam-hopping antennas and payload for a next-generation OneWeb test satellite. Additionally, they have conducted development work for ESA, which supports IRIS2 development. Securing a contract with either OneWeb or IRIS2 likely represents SatixFy’s best opportunity for a second major revenue stream.

The United States’ Space Development Agency (SDA) also presents a potential customer for phased array antennas. The SDA, procuring and launching what will likely be the fifth-largest telecommunication satellite constellation globally (by satellite count), has begun exploring the use of phased array antennas. Cesium Astro is already providing phased array antennas for SDA satellites. Cesium Astro also developing its own satellite for SDA incorporating its antennas under a recent contract. Consequently, if the SDA initiates wholesale procurement of phased array antenna satellites in the future, Cesium Astro may potentially better-positioned.

However, SatixFy’s 2024 annual report reveals $10.6 million in sales were to a confidential customer located in North America. This may be U.S. government related. Furthermore, SatixFy also had $4.3 million in sales to iDirect, a supplier to the U.S. and allied governments. Although unannounced, this could be indication of SatixFy making inroads on lucrative SDA satellites.

Yoav Leibovitch milked large bonuses when he could have made more money by growing SatixFy stock

As background, Simona Gat and Yoav Leibovitch were co-founders of SatixFy. Yoav Leibovitch currently serves as Executive Chairman of the Board and holds an M.B.A. from the Hebrew University of Jerusalem. Simona Gat served as SatixFy President until April 2023. Per SatixFy’s Form 20-F filed with the SEC on March 29, 2024, Gat beneficially owns 20.7% of outstanding SatixFy shares, and Leibovitch 27.4%. Together, they control 48.1% of SatixFy. While a minority stake, during the June 2024 SatixFy annual shareholders meeting, only 40.62% of voting shares were represented. (Gat apparently did not participate.) At a September 2024 special shareholders meeting, 72.8% of voting shares were represented. Thus, if Leibovitch and Gat both vote their shares, it’s likely they exert de facto control of SatixFy unless near-total shareholder participation occurs.

On February 1, 2022, in anticipation of the upcoming SPAC transaction, SatixFy borrowed $55 million from Francisco Partners. SatixFy’s board agreed to pay Leibovitch a $2 million bonus in connection with completion of this loan.

In October 2022, SatixFy went public via a SPAC reverse merger. Despite aiming to raise up to $350 million, the transaction was a financial disappointment for SatixFy. The board and shareholders agreed to pay Leibovitch $2 million upon the closing of the SPAC transaction. From the SPAC, SatixFy recorded a $20 million gross increase in cash ($20 million in PIPE financing and $406k from the reverse merger) but also incurred $18.7 million in transaction-related expenses. Leibovitch also earned a $2 million bonus pertaining to the SPAC closing (plus $2,059,967 in other bonuses that year). Consequently, after paying Leibovitch’s SPAC bonus, SatixFy effectively lost money by going public. Accordingly, SatixFy did not generate the cash required to repay the Francisco Partners loan post-SPAC merger. And soon SatixFy faced a cash shortage, resorting to taking on more debt and selling a business division.

In October 2023, SatixFy sold its digital payload division to MDA and entered other commercial agreements totaling $60 million. While not mentioned in SatixFy’s press release, a Form 6-K filed on August 31, 2023, advised that the SatixFy Board of Directors approved “the payment of a special bonus to the Executive Chairman of the Board in the amount of up to US $1 million for his efforts in respect of the MDA Transactions.” Thus in 2023 when SatixFy had just $10.7 million in revenue (significantly below its $36 million business plan) and a $29.7 million loss, and sold its digital payload business due to low cash reserves, it approved a $1 million transaction bonus for Yoav Leibovitch. Leibovitch was SatixFy’s highest-paid employee that year, receiving $1.2 million base salary, the $1 million bonus, and $38,309 in equity-based compensation.

SatixFy still needs cash to bridge until previously forecasted revenues and profits materialize. But if SatixFy ever achieves its own profitability forecasts, Leibovitch stands to gain significantly more through appreciation of his stock holdings. Even a $0.50 per share increase in SatixFy’s stock value would yield him $11.6 million on his 23.3 million shares. Leibovitch also holds 18,000,000 Price Adjusted Shares that vest upon reaching certain stock price targets ranging from $12.50 to $15.50 per share. If that $15.50 target is reached, his Price Adjusted Shares would be worth $279 million. Instead, Leibovitch appears more focused on extracting cash bonuses from a company in need of liquidity by taking comparatively meager $1 to 2 million bonuses.

Contrast Leibovitch with figures like Steve Jobs, who famously took a $1 annual salary while focusing on growing shareholder value. Leibovitch’s actions raise concern that he may have abandoned the goal of developing and running a profitable company, instead prioritizing short-term cash extraction through asset sales to fund his salary and bonuses.

So far, the primary financial beneficiaries of SatixFy operating as a public company appear to be Leibovitch, with his bonus payments, and the bankers and lawyers paid for their engagement in SatixFy’s financially unsuccessful SPAC transaction.

Management guidance scorecard

SatixFy’s history of providing reliable guidance to investors is suspect. SatixFy has never hit outyear guidance. The only two times they successfully hit numbers provided to investors is when they hit current year revenue forecasts in 2022 and 2024, provided just before the respective years ended.

CEO compensation and performance

SatixFy’s management structure is peculiar. Yoav Leibovitch is highest compensated and arguably appears to be de facto running the company as Executive Chairman of the Board.

Still, in three years SatixFy has had as many CEOs: David Ripstein, Ido Gur, and Nir Barkan. Nir Barkan assumed role as Acting CEO in June 2023 when SatixFy stock traded at 43 cents per share. That year Barkan received $592,072 in total compensation. In 2024 Barkan received $1.53 million in total compensation, including at least $829,000 in cash. During Barkan’s tenure as CEO, SatixFy stock has grown nearly 5-fold.

SatixFy outlook and risk assessment

If it were not for recently being bailed out by a buy-out offer from MDA, SatixFy would likely be hurting. SatixFy appears on the cusp of a major win with either supply Oneweb, IRIS2, or a U.S. government customer. With no further business divisions able to sell, SatixFy needs cash to bridge until Lightspeed payments materialize. With future constellations customers uncertain, and customers already slow to adopt SatixFy’s products, assuredness of future revenue remains dubious.

What to look from SatixFy

SatixFy stock has dropped hard since the $10 per share SPAC merger. If the MDA deal falls through, survivability depends on raising cash and acquiring another constellation customer. .

- Can SatixFy sign any customers beyond Lightspeed? They are targeting IRIS2 and Oneweb’s next generation satellite constellation. And they have $10.6 million in 2024 sales to a confidential customer and another $4.3 in apparently pass-through U.S. government sales.

- Does SDA spec-in phased arrays in future satellite tranches? And do any SDA satellite contractors partner with SatixFy?

- How will SatixFy obtain cash to fund operations until reaching positive cash flow?