As previously reported on this site, Sidus Space (NASDAQ: SIDU) released an investor presentation in October 2024 suggesting a potential annual revenue target of at least $14.6 million per LizzieSat. LizzieSat-1 and -2 launched in March and December 2024, respectively. Based on two satellites in orbit throughout Q1 2025, one might expect approximately $7.3 million in revenue from LizzieSat alone. (LizzieSat-3 launched at the end of Q1 and likely didn’t contribute significantly to Q1 revenue.) However, as long speculated, LizzieSat revenue is falling far short of Sidus management’s projections.

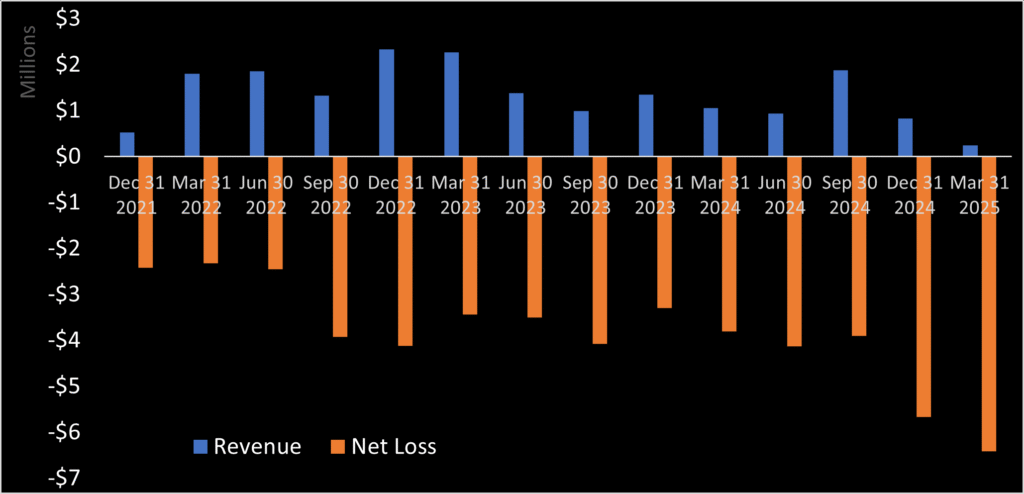

Sidus Space filed 2025 Q1 financials on May 15th. Total revenue across all business segments was ~$238,500, lowest since Q2 2021. Accompanying near-record low revenue, net loss reached record high of $6.4 million.

One apparent real Sidus Space customer is HEO, whose imager is installed on LizzieSat-2 and Lizziesat-3. HEO has similar image acquisition agreements with Blacksky, Axelspace, and Space Machines. Blacksky’s \EO contract valued over $1 million. This suggests Sidus’s contract with HEO may also be a similarly high (Sidus never disclosed the value). Sidus’s non-related party Q1 revenue totaled $161,000. This represents the absolute maximum HEO paid Sidus in Q1.

Earnings call

CEO Carol Craig and CFO Adesh Parak held an earnings call where, once again, they took no questions. Arguably this is preferable to taking questions from an analyst hired by Sidus Space. Which Sidus Space has history of doing.

Sidus Space stock traded down 10.5% on May 16th following the Q1 earnings announcement.